Market Summary

Canada Off-Road Equipment Market Overview:

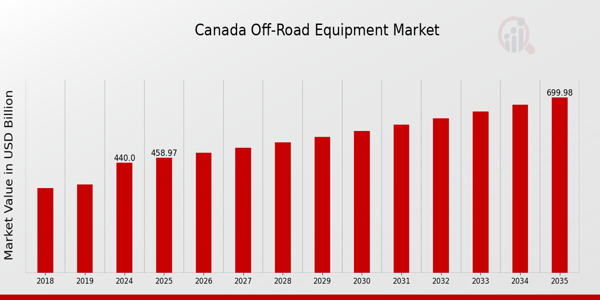

As per MRFR analysis, the Canada Off-Road Equipment Market Size was estimated at 413.41 (USD Billion) in 2024.The Canada Off-Road Equipment Market Industry is expected to grow from 440(USD Billion) in 2025 to 700 (USD Billion) by 2035. The Canada Off-Road Equipment Market CAGR (growth rate) is expected to be around 4.311% during the forecast period (2025 - 2035).

Key Canada Off-Road Equipment Market Trends Highlighted

The Canada Off-Road Equipment Market is experiencing several important trends driven by consumer preferences and environmental considerations. A significant trend is the rise in demand for electric and hybrid off-road vehicles. As Canadian consumers become increasingly environmentally conscious, there is a growing interest in equipment that minimizes carbon footprints. Electric off-road vehicles are being developed to meet rigorous efficiency standards, supported by federal initiatives promoting clean technology in transportation. Moreover, advancements in technology continue to reshape the market, with features such as GPS tracking, telemetry, and automation becoming standard in off-road equipment.The integration of smart technology enables operators to monitor their equipment in real-time, enhancing efficiency and productivity on various terrains, including forests, mines, and agricultural settings in Canada. Opportunities within this market are also expanding due to the vast Canadian landscape, including the rugged terrains of the Rockies and the diverse agricultural sectors across the provinces. As outdoor recreational activities, such as ATV riding and off-road biking, grow in popularity, there is an opportunity for manufacturers to innovate and offer more versatile and durable equipment tailored for these specific activities. In recent times, strong government policies promoting the protection of natural resources and sustainable practices have encouraged the development of off-road equipment that aligns with these goals.Overall, the shifting landscape and evolving consumer needs are shaping the future of the off-road equipment market in Canada, making it essential for companies to adapt to these developments.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Canada Off-Road Equipment Market Drivers

Growing Outdoor Recreational Activities

The growing trend of outdoor recreational activities among Canadians is a significant driver for the Canada Off-Road Equipment Market Industry. With an increase in activities such as all-terrain vehicle (ATV) riding, dirt biking, and other off-road experiences, the demand for off-road equipment is surging. According to the Canadian Off-Highway Vehicle Distributors Council, over 300,000 new off-road vehicles were registered in Canada alone in 2022, reflecting a robust interest in recreational activities.More Canadian people heading outdoors will result in greater sales and off-road activities, which will make the industry more popular in the next ten years. Additionally, this increased interest, along with associations like the Canadian Recreational Off-Highway Vehicle Association, which works towards bettering off-road access, will allow the off-road equipment industry to flourish.

Technological Advancements in Equipment

The advancement in technology related to off-road vehicles is a notable factor influencing Canada Off-Road Equipment Market Industry growth. Innovations such as improved fuel efficiency, increased engine power, and enhanced safety features are encouraging more consumers to invest in new equipment. A case in point is the rise of electric all-terrain vehicles, which are becoming popular due to their lower emissions and noise levels. Statistics from the Canadian Electric Vehicle Association indicate that electric vehicle registrations have been growing by approximately 25% annually, with many adopting electric models for off-road usage.These technological improvements are supported by companies like Bombardier Recreational Products, who are at the forefront of bringing innovative equipment to the market, thereby driving the industry forward.

Government Investments in Infrastructure

Government investments in infrastructure, particularly in rural and remote areas of Canada, are propelling the growth of the Canada Off-Road Equipment Market Industry. The Canadian government has committed substantial funding to improve rural roadways and enhance access to public trails. As rural infrastructure improves, there is a corresponding rise in the use of off-road vehicles for transportation and recreation. According to the Government of Canada, announcements of over CAD 1 billion in funding for rural infrastructure projects aim to directly impact mobility in remote areas, where off-road vehicles are essential.These investments not only enhance accessibility but also stimulate demand for off-road equipment as the market gears up to meet the newly created needs of improved infrastructures.

Rising Agricultural and Construction Activities

Increased agricultural and construction activities in Canada are significant drivers for the Canada Off-Road Equipment Market Industry. As agriculture plays a critical role in the Canadian economy, the rise in demand for both small and large-scale farming operations is necessitating the use of various off-road machinery. According to Agriculture and Agri-Food Canada, the overall farm cash receipts amounted to over CAD 80 billion in 2022, indicating a robust agricultural sector poised for growth.Additionally, the construction industry is witnessing a boom with investments in homebuilding and infrastructure projects, with Statistics Canada reporting that construction spending has risen by 7.5% annually. This sustained growth in agriculture and construction translates into amplified demand for versatile off-road equipment, positioning the market for substantial growth opportunities.

Canada Off-Road Equipment Market Segment Insights:

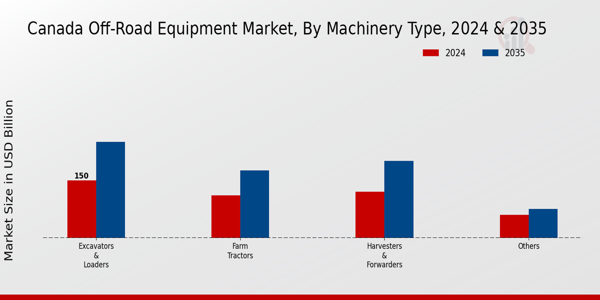

Off-Road Equipment Market Machinery Type Insights

The Canada Off-Road Equipment Market, particularly within the Machinery Type segment, provides an extensive overview of various equipment categories essential for diverse applications in agriculture, construction, and forestry sectors. In the context of Canada, which is known for its vast agricultural land and significant forestry activities, harvesters and forwarders play a crucial role in optimizing crop yields and effective timber management. Farm tractors remain backbone of Canadian agriculture, enabling farmers to perform numerous tasks efficiently, from tilling soil to transporting goods.In urban and rural construction projects, excavators and loaders are integral, serving to enhance productivity and efficiency during excavation and material handling operations. These machinery types are not only pivotal to industry growth but also reflect the technological advancements being made in the sector as equipment becomes increasingly automated and eco-friendly. The Canadian government's emphasis on innovation and sustainability in industrial practices presents further growth opportunities for the Off-Road Equipment Market as companies look to integrate smarter and greener machinery solutions.Despite challenges such as fluctuating raw material costs and supply chain disruptions, the demand for advanced machinery is expected to grow. Market statistics suggest that advancements in machinery technology will substantially drive market growth, demonstrating the critical nature of the Machinery Type segment in the broader Canada Off-Road Equipment Market. The ongoing trends of automation and precision in equipment design indicate significant shifts in market dynamics, reinforcing the importance of these machinery categories in meeting the evolving needs of Canadian industries.As equipment in this market segment continues to evolve, the focus remains on enhancing efficiency and sustainability, ensuring that Canada leverages its natural resources while maintaining environmental stewardship.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Off-Road Equipment Market End-Use Industry Insights

The Canada Off-Road Equipment Market is significantly shaped by the End-Use Industry, which includes vital sectors such as Forestry, Construction, Agriculture, and Mining. Each of these sectors plays a crucial role in driving demand for off-road equipment, given their extensive need for reliable machinery to enhance productivity. Forestry operations utilize advanced equipment for timber extraction, contributing to Canada’s sustainable forest management. In the Construction sector, demand is fueled by ongoing infrastructure development projects, with off-road machinery being essential for tasks ranging from excavation to material handling.Agriculture relies heavily on specialized off-road vehicles to boost efficiency and yield, particularly in a country known for its vast farmlands. Mining remains a substantial segment, with the need for robust equipment to navigate challenging terrains and facilitate resource extraction. As these industries evolve with technology and sustainability focuses, they continue to present substantial opportunities for growth within the Canada Off-Road Equipment Market. Emphasizing environmentally friendly practices and technological advancements will likely be key drivers for market expansion in these sectors.

Canada Off-Road Equipment Market Key Players and Competitive Insights:

The Canada Off-Road Equipment Market is characterized by a diverse range of players that contribute to the competitive landscape, reflecting the industry's steady growth and evolving technological advancements. The market is influenced by various factors, including consumer demands for rugged and reliable equipment, regulatory standards, and the increasing popularity of outdoor recreational activities. Companies operating within this space are continually innovating to enhance efficiency and sustainability while also adapting to shifts in consumer preferences and market dynamics. As a result, understanding the competitive insights in this sector reveals important trends and strategic initiatives taken by leading firms, which are critical for maintaining market share and achieving growth.Mitsubishi has established a significant presence within the Canada Off-Road Equipment Market, leveraging its strong reputation for high-quality machinery and innovative technology. The company focuses on delivering reliable equipment that meets the demanding performance requirements of various applications, including agriculture, forestry, and construction. Mitsubishi’s strength lies in its commitment to product development, which allows it to introduce advanced features that improve efficiency and user experience. Its robust distribution network ensures a wide availability of parts and services, enabling superior customer support. In Canada, Mitsubishi continues to expand its footprint through partnerships and local engagement, enhancing brand loyalty and awareness within the off-road equipment segment.Caterpillar stands out as a dominant player in the Canada Off-Road Equipment Market, renowned for its extensive portfolio of heavy machinery, including bulldozers, excavators, and all-terrain vehicles. The company's strength lies in its established brand presence and vast experience in the sector, allowing it to maintain strong customer relationships. Caterpillar not only provides a comprehensive range of products but also offers essential services such as training, maintenance, and financing, which further solidifies its market position. The company has been proactive in pursuing mergers and acquisitions to broaden its technological capabilities and product offerings, particularly focusing on sustainable solutions that align with the region's growing environmental awareness. Caterpillar's reputation for reliability and performance, combined with its continued investment in innovation, positions it as a leading force in the Canadian off-road equipment market.

Key Companies in the Canada Off-Road Equipment Market Include:

Mitsubishi

Caterpillar

Arctic Cat

Kawasaki

Honda

Yamaha

Tracker Marine

Gulfstream Boat and RV

John Deere

CanAm

Bobcat Company

Kubota

BRP

Polaris Industries

Trailtech

Canada Off-Road Equipment Market Industry Developments

The Canada Off-Road Equipment Market has seen several noteworthy developments recently. In September 2023, Polaris Industries announced the launch of a new electric off-road vehicle designed for diverse terrains, aiming to meet the growing demand for sustainable outdoor solutions. Kawasaki also introduced advanced safety features in their all-terrain vehicles, enhancing appeal among recreational users and professionals alike. In October 2023, the market experienced growth with the valuation of major players like Bobcat Company and John Deere witnessing notable increases due to heightened demand from the construction sector. Furthermore, September 2023 marked the completion of a merger between BRP and a technology firm focused on electrification, setting the stage for innovation in off-road vehicle performance. In recent years, approximately in March 2021, the industry observed a shift towards electric vehicles, driven by consumer preferences for eco-friendly options. Companies like Honda and Yamaha are investing significantly in Research and Development to expand their electric lineup, reflecting their commitment to sustainability. The Canadian government's emphasis on outdoor activities and investments in recreational infrastructure further boosts the off-road equipment sector, indicating a promising trajectory for the market ahead.

Canada Off-Road Equipment Market Segmentation Insights

Off-Road Equipment Market Machinery Type Outlook

Harvesters & Forwarders

Farm Tractors

Excavators & Loaders

Others

Off-Road Equipment Market End-Use Industry Outlook

Forestry

Construction

Agriculture

Mining

Market Size & Forecast

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 413.41(USD Billion) |

| MARKET SIZE 2024 | 440.0(USD Billion) |

| MARKET SIZE 2035 | 700.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 4.311% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Mitsubishi, Caterpillar, Arctic Cat, Kawasaki, Honda, Yamaha, Tracker Marine, Gulfstream Boat and RV, John Deere, CanAm, Bobcat Company, Kubota, BRP, Polaris Industries, Trailtech |

| SEGMENTS COVERED | Machinery Type, End-Use Industry |

| KEY MARKET OPPORTUNITIES | Electric off-road vehicle demand, Eco-friendly equipment innovations, Agricultural sector equipment growth, Adventure tourism expansion, Enhanced safety technologies integration |

| KEY MARKET DYNAMICS | rising outdoor recreation activities, increasing construction projects, technological advancements in equipment, environmental regulations and compliance, growing rental market for equipment |

| COUNTRIES COVERED | Canada |

Major Players

Canada Off-Road Equipment Market Segmentation

-

Off-Road Equipment Market By Machinery Type (USD Billion, 2019-2035)

-

Harvesters & Forwarders

-

Farm Tractors

-

Excavators & Loaders

-

Others

-

-

Off-Road Equipment Market By End-Use Industry (USD Billion, 2019-2035)

-

Forestry

-

Construction

-

Agriculture

-

Mining

-

Leave a Comment