Market Summary

China CNC Tool Cutter Grinding Machine Market Overview:

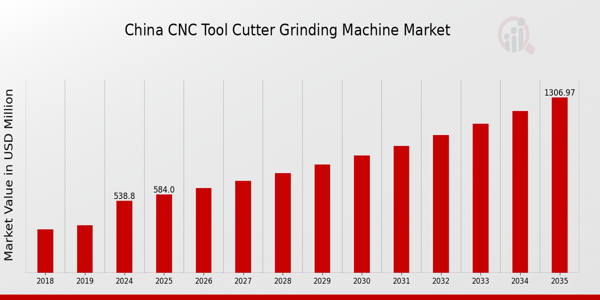

As per MRFR analysis, the China CNC Tool Cutter Grinding Machine Market Size was estimated at 516 (USD Million) in 2023. The China CNC Tool Cutter Grinding Machine Market Industry is expected to grow from 538.8(USD Million) in 2024 to 1,307 (USD Million) by 2035. The China CNC Tool Cutter Grinding Machine Market CAGR (growth rate) is expected to be around 8.389% during the forecast period (2025 - 2035).

Key China CNC Tool Cutter Grinding Machine Market Trends Highlighted

The China CNC Tool Cutter Grinding Machine Market has seen significant developments driven by the increasing demand for precision machining in various manufacturing sectors. Key market drivers include the rapid growth of industries such as automotive, aerospace, and electronics, where accuracy and efficiency are paramount. The surge in automation and the push towards Industry 4.0 in China has also played a crucial role as manufacturers seek advanced CNC machines to enhance production capabilities and maintain competitiveness. Additionally, government initiatives aimed at boosting advanced manufacturing and reducing dependency on foreign technology have stimulated the adoption of domestic CNC grinding technologies.There are numerous opportunities to be explored in the market, particularly in the areas of innovation and sustainability. As China emphasizes environmental protection, manufacturers can capture opportunities by developing energy-efficient and eco-friendly CNC grinding machines. Furthermore, the shift towards custom-made tools and the expansion of small to medium-sized enterprises can offer new avenues for market players. The integration of artificial intelligence and machine learning into CNC machines presents an exciting frontier for enhancing machine performance and predictive maintenance. Trends in recent times reflect a growing inclination toward integrating smart technologies into CNC machines for improved operational efficiency.The rise of smart factories in China has led to a higher demand for CNC machines that can connect and share data seamlessly within the production process. Additionally, there is a notable shift towards sourcing components locally as manufacturers seek to mitigate risk and bolster domestic supply chains amid global disruptions. These evolving trends highlight the dynamic environment within the China CNC Tool Cutter Grinding Machine Market, indicating a future that embraces technology, sustainability, and local production capabilities.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China CNC Tool Cutter Grinding Machine Market Drivers

Rising Demand for Precision Engineering in China

The China CNC Tool Cutter Grinding Machine Market Industry is expanding rapidly because of rising demand for precision engineering in areas such as aerospace, military, and automotive. The Ministry of Industry and Information Technology (MIIT) predicts that by 2025, the production value of China's high-end equipment manufacturing industry, which depends heavily on precision components, will approach 10 trillion CNY. With big corporations such as China National Petroleum Corporation investing extensively in modern manufacturing technologies, the need for high-performance CNC tools and related grinding machines is expected to rise. This, in response to the government's push for modernization and enhanced efficiency in production facilities, sets a solid basis for the future growth of China's CNC tool Cutter Grinding Machine industry.

Government Initiatives Supporting CNC Machine Tool Modernization

In recent years, the Chinese government has actively promoted the advancement of intelligent manufacturing and modernization of machinery, pivotal for the growth of the China CNC Tool Cutter Grinding Machine Market Industry. The National Development and Reform Commission (NDRC) has implemented policies encouraging local manufacturers to upgrade their equipment and adopt CNC technology. According to the Five-Year Plan for the Development of National Strategic Emerging Industries, the CNC machine tool sector is expected to see a substantial investment of 2 trillion CNY over the next decade, translating into higher production capacity and increased adoption of CNC cutters and grinding machines throughout the country.

Surge in Small and Medium Enterprises (SMEs) in China

The rise of small and medium enterprises (SMEs) in China is significantly driving the China CNC Tool Cutter Grinding Machine Market Industry. According to the State Administration for Industry and Commerce, SMEs now account for over 60 percent of China's GDP. These businesses are increasingly focusing on precision parts production, necessitating more advanced CNC grinding machines. With entities like the China Small and Medium Enterprise Development Fund providing financial support, SMEs are adopting modern manufacturing processes, thereby increasing the demand for CNC tool and cutter grinding machines to enhance production efficiency and product quality.

Growing Emphasis on Automation in Manufacturing Processes

The shift towards automation in manufacturing processes in China is a primary driver of the China CNC Tool Cutter Grinding Machine Market Industry. The Chinese government has earmarked $300 billion for automation upgrades in various manufacturing sectors as part of its push for Industry 4.0. Leading corporations such as Haier and Huawei are transitioning to automated production lines that require sophisticated CNC machines for smooth operations. This trend corresponds with a decrease in labor costs and improvements in efficiency and output quality, solidifying the need for advanced CNC tool cutter grinding machines across multiple industries in China.

China CNC Tool Cutter Grinding Machine Market Segment Insights:

CNC Tool Cutter Grinding Machine Market Type Insights

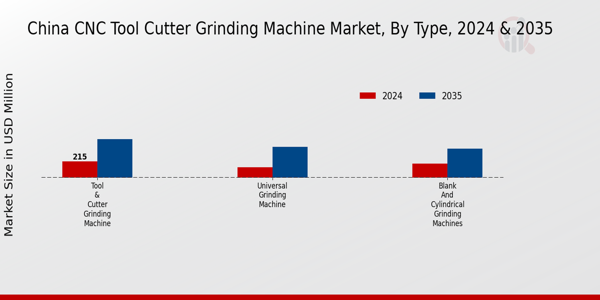

The China CNC Tool Cutter Grinding Machine Market is experiencing substantial growth, particularly within the Type segment, which comprises various critical equipment categories. Prominent among these categories are Tool and Cutter Grinding Machines, Universal Grinding Machines, and Blank and Cylindrical Grinding Machines. Tool and Cutter Grinding Machines are essential for precision manufacturing, enabling the sharpening and reshaping of cutting tools, which is crucial for maintaining efficiency in production processes. Their importance is amplified as industries increasingly emphasize operational efficiency and tool longevity, driving demand for advanced grinding solutions.Universal Grinding Machines provide versatility, allowing for the grinding of various shapes and sizes, which is particularly advantageous in sectors where multiple applications are required. This adaptability ensures that manufacturers can meet diverse customer demands without intensive retooling, thus supporting operational flexibility. Blank and Cylindrical Grinding Machines specialize in the processing of different cylindrical parts, thereby catering to a significant portion of the manufacturing sector that requires high-precision components.The market for these machines benefits from China's robust industrial landscape, which is characterized by an ongoing push for technological advancements and modernization driven by government initiatives aimed at fostering innovation and high-tech manufacturing. The continuous development of these sub-segments reflects broader trends in automation and digitalization as businesses strive to remain competitive in an increasingly globalized marketplace. Furthermore, the rising scope of applications across various industries as aerospace, automotive, and machinery, is serving as a growth driver for the Type segment, highlighting its significance in the evolving manufacturing ecosystem.The China CNC Tool Cutter Grinding Machine Market, with its diverse Type offerings, positions itself favorably to capitalize on these industry trends, presenting numerous opportunities for growth and development in the near future. Emerging technologies such as artificial intelligence and machine learning are expected to further enhance the capabilities of these machines, ensuring they remain at the forefront of manufacturing efficiency and productivity in China. Overall, the Type segment of the market is marked by a blend of tradition and innovation as manufacturers adapt to changing industry needs and technological advancements.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

CNC Tool Cutter Grinding Machine Market Application Insights

The Application segment of the China CNC Tool Cutter Grinding Machine Market is critical for various industries, reflecting the market's robust expansion. In the realm of Electrical and Electronics Manufacturing, the requirement for precision tools to create intricate components drives demand, emphasizing the need for advanced CNC grinding technologies. The Aerospace and Defense sector demonstrates significant reliance on these machines due to stringent quality and reliability standards; high-precision tool cutting is essential for producing critical parts, thereby supporting safety and efficiency in aircraft and defense systems.Meanwhile, the Automotive industry showcases substantial growth as manufacturers increasingly focus on automation and efficiency, necessitating reliable CNC machines for tool production. The combination of rapid industrialization and China's push towards technological advancements further stimulates opportunities within these sectors. Overall, the China CNC Tool Cutter Grinding Machine Market benefits from trends toward increased automation, precision manufacturing, and a growing emphasis on high-quality production across key industries.

China CNC Tool Cutter Grinding Machine Market Key Players and Competitive Insights:

The China CNC Tool Cutter Grinding Machine Market has witnessed dynamic competition, with various players vying for significant market share. Growing industrialization and the demand for precision-engineered tools in sectors such as automotive, aerospace, and manufacturing have further catalyzed the need for advanced grinding solutions. The market landscape is characterized by technological innovations, production efficiency, and a focus on meeting customer requirements. Companies in this market have invested in research and development to enhance their product offerings, ensuring higher precision and productivity at competitive prices. As the market evolves, differentiation through technology and service quality has become crucial for sustained competitive advantage.Makino has established a robust presence in the China CNC Tool Cutter Grinding Machine Market, benefiting from its advanced manufacturing capabilities and strong brand recognition. The company is noted for its high-precision machining solutions that cater to a variety of industries, making it a preferred choice among manufacturers seeking reliability and performance. The strengths of Makino lie in its commitment to innovation and customer-centric approach. Their machines are designed to integrate seamlessly into existing production lines, enhancing operational efficiencies. This adaptability contributes significantly to Makino's market appeal while ensuring that clients benefit from cost-effective production techniques and superior quality tools.Kappa has made significant inroads in the China CNC Tool Cutter Grinding Machine Market through a combination of strategic partnerships and a comprehensive product portfolio tailored to local manufacturing needs. Kappa offers a range of advanced grinding machines that are known for their precision, reliability, and user-friendly interfaces. The company actively engages in mergers and acquisitions to bolster its technological capabilities and expand its market reach, allowing Kappa to introduce state-of-the-art grinding solutions tailored for Chinese manufacturers. Their focus on research and development ensures constant innovation while also addressing evolving customer demands. Overall, Kappa's market presence in China is underscored by its strong operational framework and commitment to enhancing production processes through innovative technologies in CNC grinding machines.

Key Companies in the China CNC Tool Cutter Grinding Machine Market Include:

Makino

Kappa

WALTER Maschinenbau

Haas Automation

Hermann Schmidt

Schaublin Machines

Sodo

Toshiba Machine

DMTG

Gleason

ANCA

HAAS Automation

Schneeberger

Okuma

Walter

China CNC Tool Cutter Grinding Machine Market Industry Developments

In recent months, the China CNC Tool Cutter Grinding Machine Market has experienced noteworthy developments, particularly with companies enhancing their technological offerings to meet increasing demand from various manufacturing sectors. Notable among these are firms such as Makino and ANCA, which have introduced advanced models featuring automation to improve efficiency and precision. Current affairs also indicate a growing trend towards sustainability, prompting manufacturers like WALTER Maschinenbau and Toshiba Machine to explore eco-friendly production methods. Furthermore, in March 2023, the industry saw a significant acquisition when DMTG acquired a local competitor, expanding its market reach and technological capabilities in China. This reflects a consolidation trend within the sector, emphasizing the competitive landscape as companies strive for technological leadership. Over the past few years, the Chinese government has also prioritized advancements in manufacturing technology, boosting investments and R&D initiatives that benefit prominent players like Okuma and Haas Automation, significantly impacting market valuation and growth potential. The China's CNC Tool Cutter Grinding Machine Market was valued at approximately USD 1.4 billion in 2022, showing a compound annual growth rate of about 6% projected through 2025, reaffirming the region's pivotal role in global manufacturing supply chains.

China CNC Tool Cutter Grinding Machine Market Segmentation Insights

CNC Tool Cutter Grinding Machine Market Type Outlook

Tool & Cutter Grinding Machine

Universal Grinding Machine

Blank and Cylindrical Grinding Machines

CNC Tool Cutter Grinding Machine Market Application Outlook

Electrical and Electronics Manufacturing

Aerospace & Defense

Automotive

Market Size & Forecast

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 516.0(USD Million) |

| MARKET SIZE 2024 | 538.8(USD Million) |

| MARKET SIZE 2035 | 1307.0(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 8.389% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Million |

| KEY COMPANIES PROFILED | Makino, Kappa, WALTER Maschinenbau, Haas Automation, Hermann Schmidt, Schaublin Machines, Sodo, Toshiba Machine, DMTG, Gleason, ANCA, HAAS Automation, Schneeberger, Okuma, Walter |

| SEGMENTS COVERED | Type, Application |

| KEY MARKET OPPORTUNITIES | Growing automation in manufacturing, Rising demand for precision tools, Expansion of aerospace and automotive sectors, Increasing investment in R&D, Shift towards smart manufacturing technologies |

| KEY MARKET DYNAMICS | Technological advancements, Growing automation demand, Rising manufacturing precision requirements, Increased production efficiency, Strong industry competition |

| COUNTRIES COVERED | China |

Major Players

China CNC Tool Cutter Grinding Machine Market Segmentation

-

CNC Tool Cutter Grinding Machine Market By Type (USD Million, 2019-2035)

-

Tool & Cutter Grinding Machine

-

Universal Grinding Machine

-

Blank and Cylindrical Grinding Machines

-

-

CNC Tool Cutter Grinding Machine Market By Application (USD Million, 2019-2035)

-

Electrical and Electronics Manufacturing

-

Aerospace & Defense

-

Automotive

-

Leave a Comment