Market Summary

China Industrial Dust Collector Market Overview:

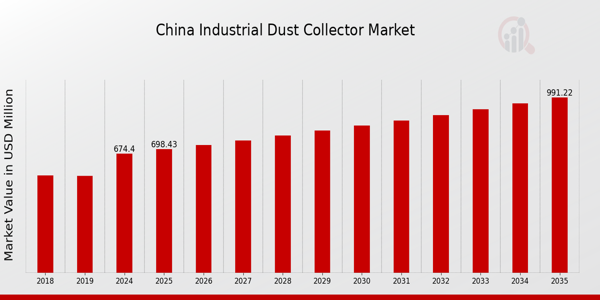

As per MRFR analysis, the China Industrial Dust Collector Market Size was estimated at 652.8 (USD Million) in 2023. The China Industrial Dust Collector Market Industry is expected to grow from 674.4(USD Million) in 2024 to 991.2 (USD Million) by 2035. The China Industrial Dust Collector Market CAGR (growth rate) is expected to be around 3.563% during the forecast period (2025 - 2035).

Key China Industrial Dust Collector Market Trends Highlighted

In China, the industrial dust collector market is witnessing notable trends driven by stringent environmental regulations aimed at reducing air pollution and improving workplace safety. The country has been actively implementing policies to control emissions, which has led to an increased adoption of advanced dust collection technologies across various industries, such as manufacturing, mining, and construction. One of the key market drivers is the growing awareness among companies about the health impacts of airborne particles, prompting them to invest in efficient dust collection systems. Opportunities are emerging in the market as industries are looking for automated and cost-effective solutions to address dust management challenges.The rise of smart manufacturing has opened doors for integrating dust collection systems with advanced technologies like IoT, allowing for better monitoring and process optimization. This trend reflects the broader shift toward digitalization in industrial operations across China. Recent times have also seen an increase in demand for portable and modular dust collectors, which offer flexibility to industries with space constraints. The push for sustainability is driving innovation in the development of eco-friendly dust collectors that use energy-efficient technologies. As China continues its transition toward greener practices in industrial operations, there is potential for growth in products that fulfill these requirements.Overall, the industrial dust collector market in China is evolving rapidly, influenced by regulatory pressure, technological advancements, and a growing focus on health and environmental sustainability.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Industrial Dust Collector Market Drivers

Stringent Environmental Regulations

China's government has enacted more rigorous environmental rules to prevent air pollution. The Ministry of Ecology and Environment has imposed higher emission regulations on industrial sites, particularly in highly polluted areas. According to government data, 35 cities in China are classed as very polluted, highlighting the critical need for appropriate industrial dust control solutions. As a consequence, the need for effective dust-collecting systems, like those found in the China Industrial Dust Collector Market Industry, is predicted to skyrocket. These laws seek to cut particulate matter emissions by more than 30% by 2030, encouraging manufacturers to use innovative dust collector systems and creating a favorable climate for industry growth.

Increase in Manufacturing Activities

China remains the world's largest manufacturing hub, contributing to nearly 28% of the global manufacturing output. The rise in manufacturing activities directly correlates with increased dust production, leading industries to seek effective dust collection solutions. Projections indicate that the manufacturing sector in China is expected to grow at a compound annual growth rate of 6% over the next decade. Furthermore, the push for Industry 4.0 initiatives is driving manufacturers to incorporate modern dust collection systems in their automated setups, thereby enhancing the prospects for the China Industrial Dust Collector Market Industry.

Growing Awareness of Workplace Safety

Workplace safety in industrial environments has seen heightened recognition among Chinese businesses, driven by the push from both the government and organizations like the All-China Federation of Trade Unions. Recent reports indicate that exposure to hazardous dust can lead to respiratory illnesses, causing the industry to focus more on air quality management. With safety regulations mandating better air quality standards, the demand for industrial dust collectors has seen a significant uptick.As awareness campaigns and training programs become more widespread, companies are increasingly investing in dust collection solutions, which positively impacts the growth of the China Industrial Dust Collector Market Industry.

China Industrial Dust Collector Market Segment Insights:

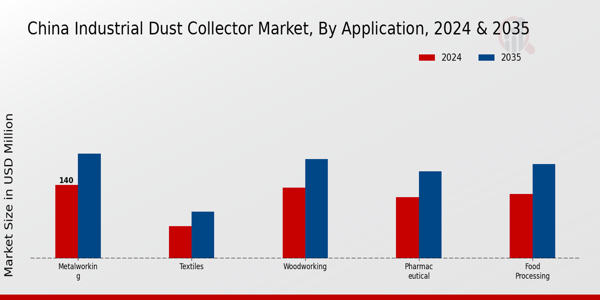

Industrial Dust Collector Market Application Insights

The China Industrial Dust Collector Market is a dynamic sector driven by the increasing need for effective air quality management across multiple applications. These applications encompass various industries, revealing the breadth and diversity of the market. A significant area within this segment is Woodworking, where dust and particles generated during processes pose both health risks and production challenges. Efficient dust collectors not only safeguard workers but also enhance product quality by preventing contamination. In the Metalworking arena, the challenges are similar, as metal shavings and dust during cutting and machining processes require robust solutions to ensure compliance with environmental regulations while promoting workplace safety. Pharmaceutical manufacturing relies heavily on stringent cleanroom standards, making high-efficiency dust collection systems critical to preventing contamination and maintaining product purity. Likewise, the Food Processing industry mandates cleanliness and safety protocols that dust collectors help uphold by capturing flour dust and other particulates, ensuring compliance with health regulations. The Textiles sector is also noteworthy, as it deals with fabric fibers and dust, necessitating effective management systems to protect both machinery and workers from potentially harmful exposures. Overall, the China Industrial Dust Collector Market segmentation reflects an intricate interplay of environmental regulations, health considerations, and industrial productivity demands, with varying applications demonstrating unique needs and challenges. As industries continue to evolve and prioritize safety and compliance, the importance of tailored dust collection solutions in enhancing operational efficiency and environmental sustainability becomes increasingly evident, contributing to the market's growth trajectory. Understanding these complexities enables stakeholders to better navigate the industry, align with regulatory standards, and capitalize on opportunities for innovation within their respective fields.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Industrial Dust Collector Market Technology Insights

The Technology segment of the China Industrial Dust Collector Market plays a crucial role in addressing air quality and environmental protection needs in the region. With increasing awareness about pollution control and stringent regulations in China, technologies such as Baghouse and Cyclone collectors have gained significant traction due to their efficiency in capturing particulate matter. The Baghouse system, in particular, is widely recognized for its reliability and efficiency in various industries, making it a popular choice among manufacturers aiming to maintain compliance with environmental standards. Cyclone collectors are also favored for their low maintenance and operational costs, providing an economical option for smaller operations. In addition, Electrostatic Precipitators are essential in heavy industries, providing effective particulate removal in high-dust environments, while Wet Scrubbers are increasingly recognized for their capability to manage volatile organic compounds and moisture-laden particles. Cartridge collectors, known for their compact design, are becoming popular among facilities constrained by space. Overall, the interplay between these technologies highlights the evolving landscape of the China Industrial Dust Collector Market, with advancements focusing on increased efficiency, lower emissions, and better compliance with environmental regulations. The continual investments in Research and Development within this segment indicate a strong commitment to adopting cleaner production processes, further driving growth in the sector.

Industrial Dust Collector Market End Use Insights

The China Industrial Dust Collector Market is influenced significantly by various end use categories, each playing a crucial role in the overall market dynamics. The manufacturing sector, comprising diverse industries, is particularly impactful as it grapples with stringent air quality regulations and the need for efficient dust management solutions. In the construction sector, the demand for dust collectors is driven by safety and health compliance, addressing the particulate matter generated at job sites. Mining operations require robust dust collection systems to mitigate environmental impacts and enhance worker safety, making this sector a key player in the market.Additionally, the chemical processing industry necessitates specialized dust collection equipment to handle toxic and hazardous materials, ensuring compliance with safety norms. Each of these sectors contributes valuable insights into the demand for advanced industrial dust collection solutions, aligning with government sustainability initiatives aimed at reducing air pollution across China. As the country prioritizes industrial growth paired with environmental responsibility, innovation in dust collector technology continues to thrive, indicating promising opportunities for market expansion within these end use categories.

Industrial Dust Collector Market Filter Type Insights

The China Industrial Dust Collector Market, particularly within the Filter Type segment, showcases a diverse array of filtration solutions designed to tackle airborne particulate pollution. As industries in China grow, stricter air quality regulations and increasing environmental awareness are driving the adoption of advanced filtration systems. HEPA Filters are known for their high-efficiency air cleaning capabilities, making them integral in industries where maintaining stringent air quality is essential. Pleated Filters provide a larger surface area for capturing dust, leading to longer service life and better performance; this makes them popular in manufacturing and textile industries.Panel Filters, being affordable and versatile, serve as an entry-level solution for dust collection needs. Meanwhile, Bag Filters dominate in larger applications due to their ability to manage vast volumes of dust effectively. The need to comply with environmental regulations, coupled with technological advancements in filtration materials, continues to support the growth and innovation within this segment of the China Industrial Dust Collector Market. The importance of these filters is highlighted by their contribution to improved workplace safety and reduced environmental impact, reflecting a broader commitment to sustainability across industry sectors in China.

China Industrial Dust Collector Market Key Players and Competitive Insights:

The China Industrial Dust Collector Market is characterized by intense competition, driven by increasing industrialization and stringent environmental regulations aimed at improving air quality in urban areas. As industries expand, the demand for effective dust collection solutions grows, leading to a diverse landscape of manufacturers and suppliers vying for market share. The competitive dynamics are influenced by technological advancements, product innovation, and customization capabilities that cater specifically to the needs of various sectors, including manufacturing, mining, construction, and automotive. Companies are focusing on enhancing operational efficiency and compliance with environmental standards to gain a competitive edge, resulting in a rapidly evolving market environment.Donaldson Company has established a prominent position within the China Industrial Dust Collector Market, recognized for its advanced filtration technology and strong brand reputation. The company benefits from a well-structured distribution network and has invested significantly in local manufacturing capabilities to meet the growing demand within the region. Donaldson Company's strengths lie in its extensive product portfolio, which includes various dust collection systems tailored to different industrial applications. Their commitment to quality and innovation in developing efficient air filtration solutions positions them favorably against competitors. Additionally, their ongoing investment in research and development ensures they remain at the forefront of technology trends in dust collection, providing significant value to their customers across China.Hpherd is gaining traction in the China Industrial Dust Collector Market, emphasizing the development of high-efficiency dust collection systems designed for diverse industrial applications. The company has successfully introduced key products that cater to specific needs within the market, including advanced filtering technologies and automated dust management systems. Hpherd's presence in China is marked by strategic partnerships and collaborations that enable them to leverage local expertise and enhance their service delivery. Furthermore, Hpherd has made strategic acquisitions to broaden its product offerings and market reach, showcasing its commitment to expansion within the region. The company's strengths lie in its agility to adapt to market changes and its focus on customer service, positioning Hpherd as a competitive player in China's dust collection industry.

Key Companies in the China Industrial Dust Collector Market Include:

Donaldson Company

Hpherd

Itoh Air System

Babcock & Wilcox

Draeger

Kentucky Air & Gas

Sinoma Technology & Equipment

C.J. Kelly

Nederman Holding

Suntech

Simatek

A. Richard

Camfil

WAMGROUP

Parker Hannifin

China Industrial Dust Collector Market Industry Developments

Recent developments in the China Industrial Dust Collector Market have illustrated a growing focus on environmental regulations and air quality improvements. Companies like Donaldson Company and Parker Hannifin are actively investing in advanced technologies to enhance dust collection efficiency, responding to the stringent policies set by the Chinese government aimed at reducing industrial emissions. In February 2023, Hpherd entered into a strategic partnership with local manufacturers to expand its market presence in southern China, highlighting the increasing competition among established firms. Notably, in August 2022, Sinoma Technology and Equipment announced an acquisition of a local competitor, significantly increasing its market share and enhancing its product offerings. The market valuation for industrial dust collectors in China has seen steady growth, with projections indicating a compound annual growth rate driven by rising industrialization and demands for cleaner air standards. In the past couple of years, key players like Camfil and Nederman Holding have made significant strides in adapting their technologies for Chinese industrial applications, showcasing innovations tailored to local environmental conditions. This dynamic landscape highlights the convergence of technological advancement and regulatory compliance in driving the evolution of the industrial dust collector market in China.

China Industrial Dust Collector Market Segmentation Insights

Industrial Dust Collector Market Application Outlook

Woodworking

Metalworking

Pharmaceutical

Food Processing

Textiles

Industrial Dust Collector Market Technology Outlook

Baghouse

Cyclone

Electrostatic Precipitator

Wet Scrubber

Cartridge

Industrial Dust Collector Market End Use Outlook

Manufacturing

Construction

Mining

Chemical Processing

Industrial Dust Collector Market Filter Type Outlook

HEPA Filters

Pleated Filters

Panel Filters

Bag Filters

Market Size & Forecast

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 652.8(USD Million) |

| MARKET SIZE 2024 | 674.4(USD Million) |

| MARKET SIZE 2035 | 991.2(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 3.563% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Million |

| KEY COMPANIES PROFILED | Donaldson Company, Hpherd, Itoh Air System, Babcock & Wilcox, Draeger, Kentucky Air & Gas, Sinoma Technology & Equipment, C.J. Kelly, Nederman Holding, Suntech, Simatek, A. Richard, Camfil, WAMGROUP, Parker Hannifin |

| SEGMENTS COVERED | Application, Technology, End Use, Filter Type |

| KEY MARKET OPPORTUNITIES | Growing industrial manufacturing sector, Strict environmental regulations enforcement, Increased focus on workplace safety, Technological advancements in filtration, Rising demand for energy-efficient solutions |

| KEY MARKET DYNAMICS | increasing industrialization, stringent environmental regulations, growing awareness of health hazards, technological advancements in filtration, rise in industrial automation |

| COUNTRIES COVERED | China |

Major Players

China Industrial Dust Collector Market Segmentation

-

Industrial Dust Collector Market By Application (USD Million, 2019-2035)

-

Woodworking

-

Metalworking

-

Pharmaceutical

-

Food Processing

-

Textiles

-

-

Industrial Dust Collector Market By Technology (USD Million, 2019-2035)

-

Baghouse

-

Cyclone

-

Electrostatic Precipitator

-

Wet Scrubber

-

Cartridge

-

-

Industrial Dust Collector Market By End Use (USD Million, 2019-2035)

-

Manufacturing

-

Construction

-

Mining

-

Chemical Processing

-

-

Industrial Dust Collector Market By Filter Type (USD Million, 2019-2035)

-

HEPA Filters

-

Pleated Filters

-

Panel Filters

-

Bag Filters

-

Leave a Comment