Market Summary

China Metal Cutting Tools Market Overview:

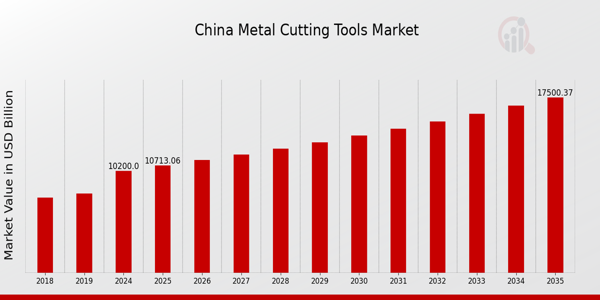

As per MRFR analysis, the China Metal Cutting Tools Market Size was estimated at 9,590.4 (USD Billion) in 2024.The China Metal Cutting Tools Market Industry is expected to grow from 10,200(USD Billion) in 2025 to 17,500 (USD Billion) by 2035. The China Metal Cutting Tools Market CAGR (growth rate) is expected to be around 5.03% during the forecast period (2025 - 2035).

Key China Metal Cutting Tools Market Trends Highlighted

The China Metal Cutting Tools Market is experiencing significant trends driven by the country's rapid industrialization and the modernization of manufacturing processes. The growing demand for efficient production methods in sectors such as automotive, aerospace, and machinery is a key market driver. Companies are increasingly focusing on precision engineering, which has led to a surge in the adoption of advanced cutting tools that enhance productivity and reduce waste. Additionally, the emphasis on automation and smart manufacturing solutions, aligned with China's Industry 4.0 initiatives, is pushing manufacturers to invest in high-tech metal cutting tools that integrate with computer numerical control (CNC) systems.There are numerous opportunities for expansion within the market, particularly in the adoption of eco-friendly materials and sustainable practices. Companies that can offer innovative cutting tools made from sustainable materials are likely to attract environmentally conscious manufacturers seeking to reduce their carbon footprint. Moreover, the growth of small and medium-sized enterprises (SMEs) in China presents a substantial opportunity for tool manufacturers to provide customized solutions tailored to specific industry needs. Recent trends indicate a shift towards high-speed machining and the use of superhard materials in cutting tools, such as polycrystalline diamond (PCD) and cubic boron nitride (CBN).This reflects a broader move within Chinese manufacturing towards higher quality and precision, driven largely by increasing global competition and stringent quality standards. Furthermore, the development of online platforms connecting tool manufacturers and end-users has enhanced accessibility and information exchange in the market, enabling more dynamic purchasing decisions. As these trends evolve, they will significantly shape the landscape of the Chinese cutting tools industry in the coming years.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Metal Cutting Tools Market Drivers

Growing Manufacturing Sector in China

China's manufacturing sector continues to be a cornerstone of its economy, contributing significantly to the demand for metal cutting tools. According to the National Bureau of Statistics of China, the manufacturing industry accounted for over 27% of the country's Gross Domestic Product (GDP) in recent years. This robust contribution is predicted to continue fostering advancements and expansions, emphasizing the need for efficient and precise tools in manufacturing processes.Major corporations such as Huawei Technologies and Geely Automobile have been enhancing their production techniques, which inevitably drives the need for advanced metal cutting tools in the China Metal Cutting Tools Market Industry. Furthermore, the recent focus on high-tech machinery production and the push for smart manufacturing initiatives align with the increasing demand for innovative metal cutting solutions. As companies invest in Research and Development (R&D) for more efficient manufacturing processes, the market for cutting tools is expected to thrive, providing critical support to machinery innovation and productivity gains across sectors.

Technological Advancements in Cutting Tools

The advancement of technology in the metal cutting tools sector in China is a significant market driver. According to data from the Ministry of Industry and Information Technology of the People's Republic of China, progress in material science and engineering is enhancing the durability and efficiency of cutting tools. Established companies like Sandvik and TaeguTec are at the forefront of innovating cutting technologies and sustainable manufacturing processes.The launch of performance and smart cutting tools that integrate automation and artificial intelligence is expected to lead to efficiency improvements across various manufacturing processes. With the ongoing transition from traditional manufacturing to Industry 4.0, the demand for smart metal cutting tools is set to surge, ensuring that the China Metal Cutting Tools Market Industry is well-equipped to meet future manufacturing challenges.

Government Initiatives and Support for Machinery Industry

The Chinese government has been actively promoting the growth of the machinery and tools industries through various initiatives, driving the metal-cutting tools market forward. Programs like 'Made in China 2025' aim to modernize manufacturing and increase the global competitiveness of Chinese machinery. The Ministry of Industry and Information Technology's emphasis on cutting-edge manufacturing technologies, including automation and smart manufacturing, creates a favorable environment for the metal-cutting tools industry.Furthermore, with increased funding and support for local enterprises, as seen in policies announced recently, the capabilities of companies in the China Metal Cutting Tools Market Industry are expected to improve significantly, promoting sustainable and innovative manufacturing practices.

China Metal Cutting Tools Market Segment Insights:

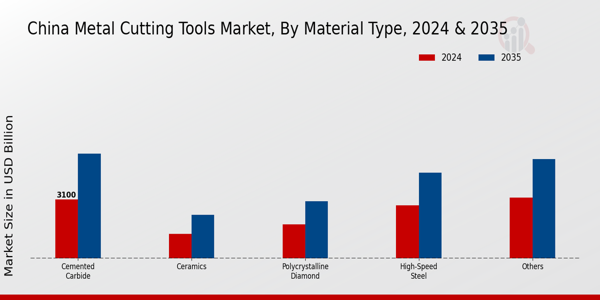

Metal Cutting Tools Market Material Type Insights

The China Metal Cutting Tools Market demonstrates a diverse landscape, particularly within the Material Type segment, which encompasses various categories such as Cemented Carbide, High-Speed Steel, Ceramics, Polycrystalline Diamond, and others. Cemented Carbide is highly favored for its ability to withstand extreme heat and pressure, making it a cornerstone in manufacturing operations across industries. This material's superior toughness and wear resistance contribute to its dominant position. High-Speed Steel, on the other hand, is prominently used due to its exceptional cutting abilities and versatility, leading to significant adoption in various metalworking processes.Meanwhile, Ceramics is recognized for its capacity to achieve high cutting speeds and superior wear resistance, catering to specialized applications where durability is critical. Polycrystalline Diamond (PCD) tools bring remarkable benefits for specific materials, offering enhanced cutting precision and longevity, thus addressing the demanding requirements of modern manufacturing sectors. Other materials also play an essential role in providing alternative solutions for specialized applications. The interplay of these material types not only drives the growth dynamics within the China Metal Cutting Tools Market but also reflects ongoing trends toward enhanced performance, efficiency, and versatility in metal cutting technologies, aligning with the advancements in automated and digitally controlled manufacturing processes emerging in China.Rising industrial demands from sectors like automotive, aerospace, and electronics, coupled with the emphasis on technological innovation, are fueling the expansion of these material types, shaping the future landscape of the industry. Overall, the segment's variety illustrates the adaptability and responsiveness of the China Metal Cutting Tools Market to evolving production needs and market challenges.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Metal Cutting Tools Market Application Insights

The China Metal Cutting Tools Market, within the Application segment, showcases a multifaceted landscape that includes Milling, Turning, Drilling, and Others, each playing a critical role in the overall market dynamics. Milling remains vital as it is extensively utilized in manufacturing processes for shaping materials and achieving precise tolerances, contributing to enhanced efficiency and product quality in numerous industries. Turning is significant for its ability to create cylindrical components, which are essential in sectors like automotive and aerospace, where precision is paramount.Drilling, on the other hand, dominates as it serves as a foundational method for creating holes and facilitating further processing in metal fabrication, making it indispensable across various manufacturing processes. The Others category encapsulates cutting tools that cater to specialized applications, demonstrating the versatility within the market. The continuous technological advancements and increasing automation in manufacturing are driving growth in these applications as industries seek to improve operational efficiencies and reduce production costs.Overall, the Application segment is expected to evolve, influenced by trends such as Industry 4.0, which promises to enhance productivity and innovation within the China Metal Cutting Tools Market.

Metal Cutting Tools Market Industry Insights

The China Metal Cutting Tools Market, focused on the Industry segment, reflects significant growth potential across various sectors, including Automotive, Aerospace and Defense, Construction, Oil and Gas, Power Generation, and Others. The Automotive industry, being one of the largest consumers, showcases a strong demand for precision tools to enhance productivity and ensure quality in manufacturing processes. Similarly, the Aerospace and Defense sector leverages advanced metal-cutting tools to meet stringent regulatory standards and combat operational challenges.In Construction, the rise of urbanization and infrastructure development necessitates efficient cutting tools to meet rapid project timelines. The Oil and Gas industry also plays a crucial role in driving demand for durable metal cutting solutions as it focuses on improving operational efficiency. Power Generation, with its emphasis on renewable energy, adopts advanced tooling technologies to maintain sustainable practices and enhance the efficiency of energy production. Overall, the segmentation of the China Metal Cutting Tools Market illustrates how diverse industrial needs are shaping market dynamics, revealing opportunities for companies to innovate and cater to specific sector requirements.

China Metal Cutting Tools Market Key Players and Competitive Insights:

The China Metal Cutting Tools Market is characterized by intense competition, driven by technological advancements and the rising demand for precision machining across various industries, including automotive, aerospace, and manufacturing. As companies strive to optimize their production processes and improve efficiencies, they continually innovate and enhance their product offerings. The market includes a diverse range of players, from established international firms to emerging local manufacturers, each vying for market share through improved product functionality, competitive pricing, and extensive distribution networks. The landscape is further shaped by ongoing trends such as automation, digitalization, and the adoption of smart manufacturing practices, which are compelling companies to evolve their product strategies to meet the sophisticated needs of the modern factory environment.Walter AG holds a significant position in the China Metal Cutting Tools Market, well-regarded for its high-quality tooling solutions that cater to a wide variety of machining requirements. The company's robust portfolio includes cutting tools for turning, milling, and drilling processes, along with specialized solutions for different material types. In China, Walter AG's strength lies in its commitment to research and development, allowing for innovative products that enhance productivity and reduce operational costs for customers. Its established presence in the region is bolstered by strong customer relationships and an extensive network of suppliers and distributors, enabling effective market penetration and a solid reputation among local manufacturers. Additionally, Walter AG offers comprehensive support services, including technical assistance and training, which further solidifies its competitive standing within the Chinese market.Tungaloy is another prominent player in the China Metal Cutting Tools Market, renowned for its advanced cutting tool technologies and solutions tailored to meet the demands of diverse industries. The company specializes in a wide array of products, such as inserts, drills, and milling tools, specifically designed to provide high-performance and reliable cutting solutions. Tungaloy's strengths in the Chinese market stem from its dedication to innovative approaches and continuous improvement, which have resulted in several key product advancements and unique cutting technologies. The company has fostered strategic partnerships and collaborations, enhancing its capabilities and expanding its market reach. Additionally, Tungaloy's focus on mergers and acquisitions has enabled the brand to bring innovative solutions to the forefront, ensuring a competitive edge in the fast-paced landscape of the Chinese metal cutting tools market. The combination of cutting-edge technology, comprehensive product offerings, and strong market presence positions Tungaloy favorably among its competitors in the region.

Key Companies in the China Metal Cutting Tools Market Include:

Walter AG

Tungaloy

YG1

OSG Corporation

Zhuzhou Cemented Carbide Group

Hanjiang Tool

Jiangsu Fuxin

Mitsubishi Materials

Kennametal

SUMITOMO Electric Hardmetal

Sandvik Coromant

Seco Tools

SANDVIK

Bohler Edelstahl

China Metal Cutting Tools Market Industry Developments

The China Metal Cutting Tools Market has seen several recent developments, reflecting a dynamic and competitive landscape. Companies such as Walter AG, Tungaloy, and YG1 are increasing their market presence through strategic investments and product innovations tailored to the specific needs of the Chinese manufacturing sector. The demand for high-precision tools is particularly growing, driven by advancements in automation and smart manufacturing technologies. Additionally, the market has witnessed notable mergers and acquisitions. For example, in May 2023, OSG Corporation announced its acquisition of a leading local tool manufacturer to enhance its production capabilities in China. Furthermore, Mitsubishi Materials announced plans in April 2023 to expand its local production facilities to meet the rising demand for metal cutting tools in the automotive and aerospace industries. The market is projected to grow significantly due to these developments, alongside China's focus on enhancing its industrial output and technological advancements. Over the past few years, investments in Research and Development have intensified, with companies aiming to develop sustainable and efficient cutting tools. This competitive environment is poised to drive innovation and increased market valuation for prominent players like Kennametal and Sandvik Coromant.

China Metal Cutting Tools Market Segmentation Insights

Metal Cutting Tools Market Material Type Outlook

Cemented Carbide

High-Speed Steel

Ceramics

Polycrystalline Diamond

Others

Metal Cutting Tools Market Application Outlook

Milling

Turning

Drilling

Others

Metal Cutting Tools Market Industry Outlook

Automotive

Aerospace & Defense

Construction

Oil & Gas

Power Generation

Others

Market Size & Forecast

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 9590.4(USD Billion) |

| MARKET SIZE 2024 | 10200.0(USD Billion) |

| MARKET SIZE 2035 | 17500.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.03% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Walter AG, Tungaloy, YG1, OSG Corporation, Zhuzhou Cemented Carbide Group, Hanjiang Tool, Jiangsu Fuxin, Mitsubishi Materials, Kennametal, SUMITOMO Electric Hardmetal, Sandvik Coromant, Seco Tools, SANDVIK, Bohler Edelstahl |

| SEGMENTS COVERED | Material Type, Application, Industry |

| KEY MARKET OPPORTUNITIES | Growing industrial automation demand, Rising automotive production needs, Expansion in aerospace manufacturing, Increased metalworking technology adoption, Surging infrastructure development projects |

| KEY MARKET DYNAMICS | growing manufacturing sector, technological advancements, increasing demand for precision, competitive pricing strategies, expansion of automotive industry |

| COUNTRIES COVERED | China |

Major Players

China Metal Cutting Tools Market Segmentation

-

Metal Cutting Tools Market By Material Type (USD Billion, 2019-2035)

-

Cemented Carbide

-

High-Speed Steel

-

Ceramics

-

Polycrystalline Diamond

-

Others

-

-

Metal Cutting Tools Market By Application (USD Billion, 2019-2035)

-

Milling

-

Turning

-

Drilling

-

Others

-

-

Metal Cutting Tools Market By Industry (USD Billion, 2019-2035)

-

Automotive

-

Aerospace & Defense

-

Construction

-

Oil & Gas

-

Power Generation

-

Others

-

Leave a Comment