Market Summary

China Metal Foundry Products Market Overview:

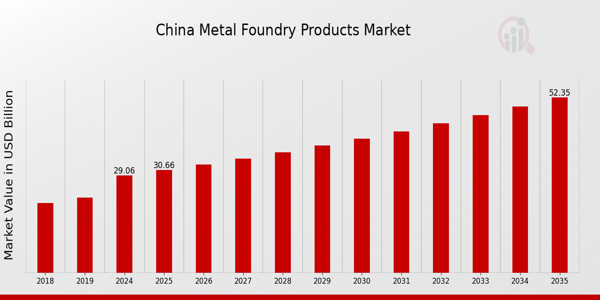

As per MRFR analysis, the China Metal Foundry Products Market Size was estimated at 27.68 (USD Billion) in 2024.The China Metal Foundry Products Market Industry is expected to grow from 29.06(USD Billion) in 2025 to 52.34 (USD Billion) by 2035. The China Metal Foundry Products Market CAGR (growth rate) is expected to be around 5.497% during the forecast period (2025 - 2035).

Key China Metal Foundry Products Market Trends Highlighted

The China Metal Foundry Products Market is experiencing significant growth driven by several key market drivers. The rapid industrialization and urbanization in China have led to an increased demand for metal foundry products in construction, automotive, and machinery sectors. Government initiatives aimed at enhancing manufacturing capabilities and promoting advanced technologies in metal casting are also pivotal in accelerating market development. These initiatives include investment in research and development, as well as support for green foundry technologies, which align with China's commitment to environmental sustainability. Opportunities within the China Metal Foundry Products Market are expanding, especially with the rise of industries such as renewable energy and electric vehicles.The push for innovation in materials and processes offers foundries a chance to diversify their product offerings and cater to new markets. Furthermore, the local government is encouraging the adoption of smart manufacturing solutions, which is creating a shift towards automation in foundry processes. Recent trends in the China Metal Foundry Products Market highlight an increase in the usage of advanced materials and the incorporation of digital technologies, such as 3D printing and IoT, to increase efficiency and reduce waste. The demand for lightweight and high-performance products is influencing foundries to focus on aluminum and magnesium alloys, which are prevalent in various applications, including automotive components.Additionally, the drive towards sustainable practices is compelling foundries to invest in recycling capabilities and the use of eco-friendly materials, signifying a transformative phase in the market. Overall, the combination of industrial growth, technological advancements, and sustainability initiatives are framing the trajectory of the Metal Foundry Products Market in China.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Metal Foundry Products Market Drivers

Increasing Demand in Automotive Sector

The automotive sector in China is one of the largest consumers of metal foundry products, contributing significantly to the growth of the China Metal Foundry Products Market Industry. With the government's 'Made in China 2025' initiative aimed at elevating manufacturing capabilities, the automotive industry is anticipated to witness a continuous rise in demand for metal components. According to the China Association of Automobile Manufacturers, vehicle production in China surged to over 25 million units in the last year alone.Such a demand translates to a need for high-grade castings utilized for parts manufactured for engines, transmissions, and other important parts, which affects the overall development trajectory of the market for metal foundry products substantially.

Infrastructure Development Projects

The Chinese government's commitment to infrastructure development is a crucial driver for the China Metal Foundry Products Market Industry. With the announcement of the '14th Five-Year Plan,' the focus on enhancing infrastructure, including transportation networks, energy projects, and urban development, is expected to escalate the demand for metal foundry products. The China National Development and Reform Commission projected an overall investment of approximately USD 4.6 trillion in such infrastructure projects over the next several years.This investment directly correlates to increased production of metal castings needed for construction machinery, railways, and other infrastructure-related applications.

Technological Advancements in Manufacturing

Technological innovations in manufacturing processes are propelling the growth of the China Metal Foundry Products Market Industry. Advances such as 3D printing and automation are improving the efficiency and precision of metal casting processes, allowing producers to meet rising quality standards. The Ministry of Industry and Information Technology of China has reported a significant increase in investment in Research and Development in manufacturing technologies, with funding reaching around USD 150 billion in the last fiscal year.This focus on technology not only boosts productivity but also enables manufacturers to explore new types of metal alloys and casting methods, which in turn stimulate market growth.

China Metal Foundry Products Market Segment Insights:

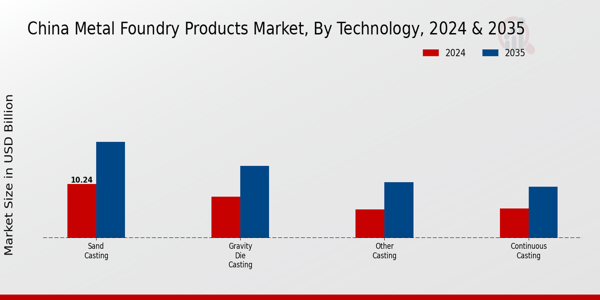

Metal Foundry Products Market Technology Insights

The Technology segment of the China Metal Foundry Products Market encompasses various advanced methodologies that are essential in providing customized and high-quality metal components. Among these, Sand Casting holds a prominent position due to its versatility and cost-effectiveness, making it a prevalent choice in industries ranging from automotive to aerospace. This technique allows for the easy creation of complex shapes and large castings, thus showcasing its significance in fulfilling diverse industrial demands. Gravity Die Casting follows, wherein molten metal is poured into a reusable mold to achieve intricate designs and superior finishing.This method is crucial for producing high-volume components with improved dimensional accuracy, making it a favorite among manufacturers seeking efficiency and reduced waste. Continuous Casting is another key technology that supports the production of long metal sections which can be further processed or directly used in applications, reflecting its importance in the production cycle. This technique aids in enhancing yield rates and streamlining operations. Other Casting methods, although they may hold a smaller market share, still play a vital role by incorporating innovative practices and materials to meet niche requirements.Overall, the advancement of technology in metal foundry practices is pivotal in driving the China Metal Foundry Products Market forward, fostering growth and adaptability in an ever-evolving industrial landscape. The integration of modern technological solutions not only enhances production efficiency but also responds to increasing demands for sustainability and precision in manufacturing, thus addressing significant market trends while enabling companies to leverage new opportunities. With the rising industrialization and urban development in China, these technologies will continue to evolve, catering to a growing market need for metal components that conform to stringent quality standards and performance requirements.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Metal Foundry Products Market Product Mix Insights

The China Metal Foundry Products Market focuses on a diverse Product Mix, which is primarily categorized into Ferrous and Non-Ferrous materials. Ferrous products dominate the landscape due to their widespread applications in construction, automotive, and heavy machinery sectors, showcasing their crucial role in the industrial infrastructure of China. The availability of iron ore, a primary raw material, bolsters the production capabilities of Ferrous foundries, making these products integral to domestic and international supply chains. In contrast, Non-Ferrous products, known for their lightweight and resistance to corrosion, find significant use in industries like aerospace and electronics, where performance and durability are paramount.As China moves towards advanced manufacturing initiatives, the demand for high-quality Non-Ferrous products is expected to increase, offering opportunities for innovation and market growth. Overall, the segmentation of the China Metal Foundry Products Market underscores the importance of both Ferrous and Non-Ferrous segments in meeting diverse industrial requirements, driving advancements in technology, and responding to environmental regulations and sustainability trends. These insights demonstrate the dynamic nature of the market, which is expected to evolve in alignment with global economic developments and domestic industrial policies.

Metal Foundry Products Market Application Insights

The Application segment of the China Metal Foundry Products Market is characterized by its diverse range of applications across various industries, reflecting both the growth and adaptability of the market. Key applications include Backing Plates, Brake Calipers and Carriers, Brake Disks, and Crank Cases, which are crucial in the automotive sector where precision and durability are paramount. The significance of these applications lies in their contribution to vehicle safety and performance, indicating a steady demand driven by the booming automotive industry in China.Additionally, applications such as Agricultural Machine Parts and Industrial Hydraulic Housing showcase the increasing reliance on metal foundry products in machinery and equipment, enhancing operational efficiency in both agricultural and industrial sectors. The growing usage of Pump components and Crusher and Grinder Parts in construction and mining further signifies the pivotal role of metal foundry products in essential operations. With continuous advancements and increasing automation within these industries, the Application segment remains vital, supporting the overall growth trajectories within the China Metal Foundry Products Market, ultimately aligning with the nation’s economic development goals and infrastructure projects.

Metal Foundry Products Market End-use Insights

The China Metal Foundry Products Market is characterized by its diverse end-use applications, reflecting the multifaceted nature of industrial growth within the region. The automotive industry stands out as a significant consumer, driven by the increasing production of vehicles and a shift towards electric mobility, which necessitates advanced foundry products for components. In the construction sector, the demand for durable materials for infrastructure development propels the market, especially as China continues to invest in urbanization and smart cities.The industrial segment also plays a crucial role, with metal foundry products being integral to machinery and equipment manufacturing. Agriculture remains significant, as the sector increasingly utilizes metal components for equipment and tools to enhance productivity. Water treatment applications are expanding due to heightened environmental concerns and regulations, fostering demand for efficient foundry products. Similarly, the aerospace and defense sectors require high-performance materials, driving innovations in metal foundry technologies to meet stringent safety and quality standards.The mining industry requires robust components to withstand harsh conditions, while the packaging segment is leaning towards lightweight yet strong materials. The combination of these factors positions the China Metal Foundry Products Market as a dynamic space with enormous potential for growth across various end-use sectors.

China Metal Foundry Products Market Key Players and Competitive Insights:

The China Metal Foundry Products Market is characterized by fierce competition driven by a combination of domestic demand, technological advancements, and afocus on quality. The sector is diverse, encompassing various products including cast iron, aluminum castings, and copper foundries, which serve numerous industries such as automotive, aerospace, and machinery manufacturing. The market's landscape is shaped by both well-established names and emerging players, each striving to enhance their market share through innovation, strategic partnerships, and expanded production capacities. The growing emphasis on sustainability and eco-friendly practices is also influencing competitive dynamics as companies invest in greener technologies and processes to meet changing regulations and consumer expectations.Hebei Iron and Steel Group has solidified its position as a leading player in the China Metal Foundry Products Market. Renowned for its strong technical capabilities and large-scale operations, the company leverages its expertise in metal casting to produce high-quality foundry products that cater to various industries. The firm's extensive distribution network and strong relationships with key industry stakeholders enable it to maintain a significant market presence. Additionally, Hebei Iron and Steel Group focuses on continuous improvement and innovation, which enhances its competitive edge. The company's robust financial performance also empowers it to invest in modernizing facilities and expanding production capabilities, further solidifying its position within the market.Ningbo Jintian Copper Group stands out in the China Metal Foundry Products Market primarily due to its specialization in copper-related products. The company's product portfolio includes a wide range of copper castings and machined parts, targeting sectors like electrical engineering, electronics, and renewable energy. Ningbo Jintian Copper Group's commitment to quality assurance and technological advancement has earned it a reputation for reliability and performance. With an established presence in both domestic and international markets, the company is well-positioned to capture growth opportunities stemming from rising demand in specific industries. Moreover, the company's ongoing investment in innovation, including recent mergers and acquisitions aimed at expanding its technological capabilities, signifies its strategic approach tostrengthen its market position. Through these actions, Ningbo Jintian Copper Group continues to enhance its competitive landscape within China's metal foundry industry.

Key Companies in the China Metal Foundry Products Market Include:

Hebei Iron and Steel Group

Ningbo Jintian Copper Group

China National Chemical Corporation

Shanxi Taigang Stainless Steel

Anhui Conch Cement

Jiangxi Copper Corporation

Baosteel Group

Hunan Valin Steel

Sinosteel Corporation

Beijing ZL Engineering

Lingyun Industrial Corporation

Zhongtai Steel

China First Heavy Industries

China National Building Material Group

China Metal Foundry Products Market Industry Developments

The China Metal Foundry Products Market has recently seen significant developments, particularly with companies such as Hebei Iron and Steel Group and Baosteel Group actively pursuing technological advancements in production processes to enhance efficiency and sustainability. In August 2023, China National Chemical Corporation announced a strategic collaboration with Jiangxi Copper Corporation to innovate in metal recycling technologies, aiming to reduce environmental impact. Additionally, in September 2023, Shanxi Taigang Stainless Steel and Hunan Valin Steel reported expansion plans to increase production capacity, responding to rising domestic demand.In notable mergers and acquisitions, Ningbo Jintian Copper Group in October 2023 acquired a smaller competitor, which is expected to strengthen its market position and expand its manufacturing capabilities. Similarly, Lingyun Industrial Corporation announced plans in November 2023 for a merger with Beijing ZL Engineering, anticipated to create a stronger entity in the metal foundry segment. The growth in market valuation of companies, driven by continued investments and advancements, is positively impacting the overall market landscape, encouraging further innovation and expansion within the sector.

China Metal Foundry Products Market Segmentation Insights

Metal Foundry Products Market Technology Outlook

Sand Casting

Gravity Die Casting

Continuous Casting

Other Casting

Metal Foundry Products Market Product Mix Outlook

Ferrous

Non-Ferrous

Metal Foundry Products Market Application Outlook

Backing Plates

Brake Caliper and Carriers

Brake Disks

Camshaft and Balancing Shafts

Commercial Vehicle Calipers

Differential Case

Pumps

Industrial Hydraulic Housing

Lanchester Balancing System

Wheel Flange

Glass Bottle Mould

Crank Case

Compressor Parts

Agricultural Machine Parts

Earthwork Machine Parts

Crusher & Grinder Parts

Tooling and Grinding Products

Other Applications

Metal Foundry Products Market End-use Outlook

Automotive

Construction

Industrial

Agriculture

Water Treatment

Aerospace and Defense

Mining

Packaging

Other End-Use

Market Size & Forecast

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 27.68(USD Billion) |

| MARKET SIZE 2024 | 29.06(USD Billion) |

| MARKET SIZE 2035 | 52.34(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.497% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Hebei Iron and Steel Group, Ningbo Jintian Copper Group, China National Chemical Corporation, Shanxi Taigang Stainless Steel, Anhui Conch Cement, Jiangxi Copper Corporation, Baosteel Group, Hunan Valin Steel, Sinosteel Corporation, Beijing ZL Engineering, Lingyun Industrial Corporation, Zhongtai Steel, China First Heavy Industries, China National Building Material Group |

| SEGMENTS COVERED | Technology, Product Mix, Application, End-use |

| KEY MARKET OPPORTUNITIES | Rising automotive industry demand, Advanced manufacturing technologies adoption, Increased infrastructure spending, Growing renewable energy projects, Expansion of export markets |

| KEY MARKET DYNAMICS | Growing automotive industry demand, Increasing infrastructure investments, Adoption of advanced technologies, Rising environmental regulations, Competitive pricing pressures |

| COUNTRIES COVERED | China |

Major Players

China Metal Foundry Products Market Segmentation

-

Metal Foundry Products Market By Technology (USD Billion, 2019-2035)

-

Sand Casting

-

Gravity Die Casting

-

Continuous Casting

-

Other Casting

-

-

Metal Foundry Products Market By Product Mix (USD Billion, 2019-2035)

-

Ferrous

-

Non-Ferrous

-

-

Metal Foundry Products Market By Application (USD Billion, 2019-2035)

-

Backing Plates

-

Brake Caliper and Carriers

-

Brake Disks

-

Camshaft and Balancing Shafts

-

Commercial Vehicle Calipers

-

Differential Case

-

Pumps

-

Industrial Hydraulic Housing

-

Lanchester Balancing System

-

Wheel Flange

-

Glass Bottle Mould

-

Crank Case

-

Compressor Parts

-

Agricultural Machine Parts

-

Earthwork Machine Parts

-

Crusher & Grinder Parts

-

Tooling and Grinding Products

-

Other Applications

-

-

Metal Foundry Products Market By End-use (USD Billion, 2019-2035)

-

Automotive

-

Construction

-

Industrial

-

Agriculture

-

Water Treatment

-

Aerospace and Defense

-

Mining

-

Packaging

-

Other End-Use

-

Leave a Comment