Market Summary

China Overhead Conveyor Systems Market Overview:

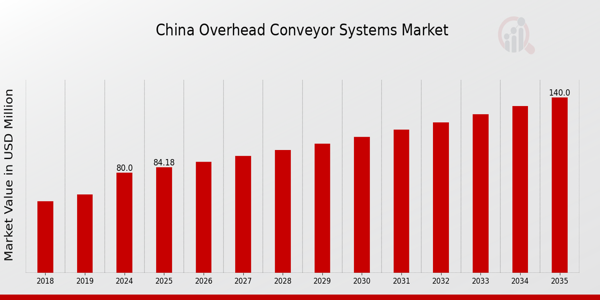

As per MRFR analysis, the China Overhead Conveyor Systems Market Size was estimated at 75.6 (USD Million) in 2024.The China Overhead Conveyor Systems Market Industry is expected to grow from 80(USD Million) in 2025 to 140 (USD Million) by 2035. The China Overhead Conveyor Systems Market CAGR (growth rate) is expected to be around 5.219% during the forecast period (2025 - 2035).

Key China Overhead Conveyor Systems Market Trends Highlighted

In the China Overhead Conveyor Systems Market, automation and digitalization are emerging as crucial market drivers. As industries seek greater efficiency and reduced labor costs, the adoption of automated overhead conveyor systems is increasing. This shift aligns with the Chinese government's push for advanced manufacturing and "Made in China 2025," aiming to enhance productivity across various sectors. Another noteworthy trend is the growing focus on sustainability and environmental regulations, which encourage manufacturers to adopt energy-efficient and eco-friendly conveyor systems. Moreover, the rise of e-commerce and rapid urbanization in China are creating significant opportunities to be explored.With the growth of warehouses and distribution centers, there is a heightened demand for efficient material handling solutions, including overhead conveyor systems. Companies can capture market share by developing tailored solutions that meet the specific logistic needs of e-commerce players in urban areas. In recent times, there a notable trend towards integrating IoT technologies into overhead conveyor systems. This innovation allows for real-time monitoring and predictive maintenance, enhancing overall system performance. Chinese manufacturers are increasingly looking to incorporate smart technologies to improve operational reliability and reduce downtime.Additionally, customization is becoming important as businesses seek conveyor systems that can be adapted to the unique layout and workflow of their facilities. As these trends continue to evolve, the market landscape in China is likely to see further transformations driven by innovation and a focus on meeting modern industrial challenges.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Overhead Conveyor Systems Market Drivers

Growing Demand for Automated Solutions in Manufacturing

The China Overhead Conveyor Systems Market Industry is experiencing significant growth due to the increasing demand for automation in various sectors, particularly manufacturing. According to the Ministry of Industry and Information Technology of China, the level of automation in Chinese manufacturing enterprises is expected to increase by 25% by 2025. This robust push for automation aims to enhance operational efficiency and reduce labor costs, thereby making systems like overhead conveyors more attractive.Companies such as Siemens and FANUC are investing heavily in automation technology in China, further promoting the adoption of overhead conveyor systems. With a projected enhancement in operational productivity, this trend is expected to propel the market to achieve a compound annual growth rate (CAGR) of 5.219% from 2025 to 2035 as manufacturers seek more efficient material handling solutions.

Surge in E-commerce and Retail Sector

The explosive growth of the e-commerce sector in China is significantly driving the China Overhead Conveyor Systems Market Industry. The China E-commerce Research Center forecasts that online retail sales in China will surpass 12 trillion Chinese Yuan by 2025. This surge in e-commerce necessitates efficient logistics and warehousing solutions, where overhead conveyor systems can streamline the processing and sorting of goods. Major players, such as Alibaba and JD.com, are implementing advanced automated systems, including overhead conveyors, to meet high-volume logistics demands.This increasing reliance on automated systems in warehousing and distribution operations is expected to positively impact the market, encouraging adoption among retailers looking to improve efficiency.

Government Initiatives for Industry 4.0

The Chinese government has been proactive in promoting initiatives related to Industry 4.0, which focuses on smart manufacturing and automation technologies. Under the Made in China 2025 plan, there is an emphasis on upgrading traditional manufacturing units with modern automation solutions. Various reports from the National Development and Reform Commission indicate that approximately 70% of manufacturing companies are investing in advanced manufacturing technologies by 2025.This government initiative improves the fabrication environment and, at the same time, provides monetary rewards to businesses that expand their implementation of overhead conveyor systems. Such initiatives will probably increase the market for these systems in both new and already established manufacturing setups in China, thus accelerating the growth of the industry.

China Overhead Conveyor Systems Market Segment Insights:

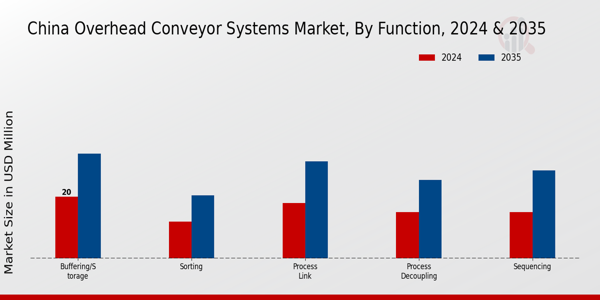

Overhead Conveyor Systems Market Function Insights

The China Overhead Conveyor Systems Market is experiencing significant growth, driven by various functions that optimize operational efficiency across multiple industries. The Function segment plays a crucial role in shaping this market, with different applications such as Process Link, Process Decoupling, Buffering/Storage, Sorting, and Sequencing, each contributing uniquely to overall efficiency. Process Link functions are essential in connecting and integrating different stages of production, ensuring that materials are transported seamlessly from one phase to another. This reduces downtime and enhances productivity within manufacturing processes. Process Decoupling functionalities are increasingly important, as they enable flexibility in operations and facilitate maintenance without affecting overall workflow, addressing a key need for modern manufacturing and assembly lines in China’s bustling industrial sector.

Buffering/Storage functionalities contribute to the systematic organization of goods in manufacturing facilities, creating a flow that enhances space utilization while also minimizing handling time. This is particularly relevant in industries such as automotive and electronics, where just-in-time production strategies are prevalent. Sorting operations are vital in ensuring that products are accurately categorized and directed to the appropriate locations, which is crucial in logistics and order fulfillment environments.

Sequencing functions, on the other hand, enhance the coordination of production lines by ensuring that materials arrive in the specific order needed for assembly or processing. This is essential in industries where different components must be combined in a particular sequence, further improving efficiency and reducing errors. The overarching trend in the China Overhead Conveyor Systems Market indicates a clear movement towards automation and enhanced control, aligning with the nation’s broader manufacturing goals and technological advancements.

Each of these functional aspects serves to streamline operations, reduce waste, and enhance productivity, reflecting the growing importance of overhead conveyor systems in facilitating efficient manufacturing processes within China. As industries in the region continue to evolve, the demand for advanced overhead conveyor functions will likely increase, underscoring the segment's relevance in supporting the nation’s industrial backbone.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Overhead Conveyor Systems Market Technology Insights

The China Overhead Conveyor Systems Market has been undergoing significant developments, particularly in the Technology segment. This segment comprises various advanced systems designed to enhance efficiency and productivity in industrial environments. The Pouch Sorter is a noteworthy technology, playing a crucial role in automated material handling. Its ability to streamline operations in logistics and distribution centers makes it an essential component in e-commerce and retail sectors. Meanwhile, the Power and Free System offers flexibility and versatility in manufacturing operations, allowing for independent movement of loads.This adaptability enables companies to optimize their production lines effectively, thereby increasing throughput and reducing downtime. Furthermore, technological advancements in automation and robotics are expected to drive growth in this segment as manufacturers seek to implement more efficient systems. The growing emphasis on smart factories and Industry 4.0 initiatives in China is expected to bolster the adoption of these technologies, leading to enhanced operational efficiencies and cost reductions. Overall, the Technology segment of the China Overhead Conveyor Systems Market demonstrates immense potential, supported by the evolving industrial landscape and commitment to modernization.

Overhead Conveyor Systems Market Weight Insights

The Weight segment of the China Overhead Conveyor Systems Market is a critical area of focus due to varying industrial needs for material handling. This segment is characterized by a diverse range of weight classifications, allowing for tailored solutions in different manufacturing and logistics environments. Within this category, the 0-3 kg and 3-5 kg ranges are particularly significant, as they cater to lightweight and smaller items that are commonly handled in sectors like electronics and packaging, promoting efficient operations and reducing labor costs.The 5-10 kg and 10-20 kg categories support medium-weight applications, ideal for automotive and food processing industries where intermediate load handling is essential. Meanwhile, the 20-50 kg range meets the requirements of duty industries, including construction and heavy machinery, where robust solutions are imperative. As industries in China continue to modernize and digitize, the demand for efficient overhead conveyor systems across these weight classifications is expected to rise, driven by advancements in technology and increasing need for productivity outcomes in manufacturing processes.Overall, these weight categories play a strategic role in enhancing operational efficiency and optimizing supply chain logistics in various sectors throughout China.

Overhead Conveyor Systems Market Capacity Insights

The Capacity segment of the China Overhead Conveyor Systems Market plays a vital role in shaping the operational efficiencies across various industries in the region. As businesses continue to automate their processes, the demand for conveyors capable of handling varying item throughput has gained prominence. The categories "Upto 1000 items per hour," "1000 to 10,000 items per hour," and ">10,000 items per hour" cater to diverse industry needs, from small-scale assembly lines to large manufacturing facilities. Particularly, the segment handling over 10,000 items per hour is significant, as it addresses the needs of high-volume production environments that require efficient handling to sustain competitive advantage.This is especially relevant in industries such as automotive, electronics, and food processing, where speed and accuracy are critical. In China, where manufacturing technology is rapidly advancing, these conveyor capacities are crucial for improving throughput efficiency and reducing operational costs. As a result, the ongoing shift towards automation in Chinese industries strongly drives the demand for advanced overhead conveyor systems, positioning the Capacity segment as a key factor in the market's growth trajectory.

Overhead Conveyor Systems Market Sales Channel Insights

The Sales Channel segment of the China Overhead Conveyor Systems Market is an essential component that plays a significant role in overall market dynamics. The two primary distribution pathways within this segment are Direct sales and sales Via Main Contractors. Direct sales provide manufacturers with the opportunity to engage closely with customers, offering tailored solutions and fostering relationships that can lead to long-term contracts. This channel is particularly important in sectors such as automotive and electronics, where precision and customization are crucial.On the other hand, sales Via Main Contractors dominate a significant portion of the market, as these contractors often have established relationships with various industries and possess expertise in integrating overhead conveyor systems into large-scale projects. This approach enables manufacturers to leverage the contractor’s knowledge and resources, thereby ensuring efficient implementation and potentially reducing project timelines. The growth of industries in China, such as manufacturing and logistics, is further driving the demand through these channels as companies seek efficient and reliable solutions to support their production processes.Both channels present substantial opportunities for manufacturers looking to capitalize on the expanding market needs in China.

Overhead Conveyor Systems Market Automation Grade Insights

The China Overhead Conveyor Systems Market has seen significant growth driven largely by the varying Automation Grade systems, each catering to different operational needs. The Manual segment plays a crucial role, particularly in industries where flexibility is paramount, allowing workers to handle materials directly while optimizing production line adaptability. In contrast, the Semi-Automatic segment is gaining traction as it blends human intervention with mechanized processes, thus enhancing efficiency while still allowing for some level of manual control.This segment is particularly favored in industries like manufacturing and distribution, as it effectively bridges the gap between fully manual and fully automated systems. The Automatic segment is becoming increasingly dominant due to advancements in technology and the growing emphasis on reducing labor costs and improving throughput. As the demand for high-speed, efficient operations rises, more companies are transitioning towards automation, recognizing its potential to significantly enhance operational efficiency. Overall, the evolution of these segments reflects the broader trends in the China Overhead Conveyor Systems Market, with increasing automation driving innovation and investment across various sectors.

Overhead Conveyor Systems Market Application Insights

The Application segment of the China Overhead Conveyor Systems Market is essential in driving the industry forward, especially within the dynamic sectors of E-Commerce/Retail, Logistics, and Production Processes. E-and retail are experiencing rapid growth, fueled by increasing online shopping trends and the need for efficient order fulfillment systems. This has led to a significant demand for overhead conveyor systems, which streamline the movement of goods and enhance operational efficiency. Logistics is also a key player, as these systems help warehouses optimize space and reduce handling times, accommodating the rising demand for quicker delivery solutions.In production processes, overhead conveyor systems facilitate the seamless transport of materials and components, improving workflow and reducing labor costs. The emphasis on automation and efficiency in these applications showcases their dominating role in the market, supporting the overall growth trajectory of the China Overhead Conveyor Systems Market. With a focus on sustainable practices, these sectors are likely to further harness overhead systems, contributing to advanced solutions that meet evolving industry needs.

China Overhead Conveyor Systems Market Key Players and Competitive Insights:

The China Overhead Conveyor Systems Market is characterized by a dynamic competitive landscape driven by the escalating demand for automation in various industries, such as manufacturing, logistics, and retail. As companies seek efficient ways to streamline their operations and reduce labor costs, there has been a notable uptick in the adoption of overhead conveyor systems. This sector is marked by the presence of both established players and emerging firms, each vying for market share through technological innovation, product diversification, and strategic partnerships. The competitive environment is intense, with businesses focusing on enhancing their offerings to meet specific industry needs, such as customization, load capacity, and operational efficiency. Factors influencing competition include advancements in material handling technologies, increasing investments in industrial automation, and the overall economic growth in China, which has positioned the region as a hub for manufacturing and logistics.Tecnoideal has established a strong foothold in the China Overhead Conveyor Systems Market by leveraging its technological expertise and innovative product offerings. The company is well-known for its customizable solutions that address the unique requirements of clients across various industries, including automotive, electronics, and food processing. Tecnoideal's strengths lie in its ability to provide tailored systems that enhance productivity and operational efficiency while ensuring workplace safety. The company’s commitment to research and development enables it to regularly introduce new products and upgrades, keeping pace with industry advancements. Furthermore, Tecnoideal has built a reliable network of distributors and partners across China, enhancing its market presence and allowing for improved customer service and support.Daifuku is a prominent player in the China Overhead Conveyor Systems Market, recognized for its robust product portfolio and comprehensive solutions that cater to a broad spectrum of industrial needs. The company specializes in advanced material handling systems, including a range of overhead conveyor solutions that are designed for high efficiency and reliability. Daifuku has a well-established presence in China, supported by a strong operational network, which allows it to respond quickly to market demands. Its strengths include a deep understanding of customer needs and a commitment to providing integrated solutions that optimize manufacturing processes. Daifuku has also engaged in strategic mergers and acquisitions to bolster its capabilities and expand its market share in China, further solidifying its position in the industry. With a focus on innovation and customer-centric solutions, Daifuku continues to play a significant role in shaping the future of overhead conveyor systems in the Chinese market.

Key Companies in the China Overhead Conveyor Systems Market Include:

Tecnoideal

Daifuku

US Conveyor Technologies

Vanderlande

Siemens

Fives Group

Adept Technology

TGW Logistics Group

Interroll

Cavotec

Schaefer Systems International

Systec

KUKA

China Overhead Conveyor Systems Market Industry Developments

The China Overhead Conveyor Systems Market has witnessed significant developments in recent months. Notably, Tecnoideal initiated a new project in July 2023 focusing on enhancing efficiency in the automotive sector through innovative conveyor solutions. Meanwhile, Daifuku has expanded its manufacturing capabilities in Shanghai, enabling better service for the local market since August 2023. In terms of mergers and acquisitions, Siemens acquired a controlling stake in a local Chinese logistics automation firm in September 2023 to further enhance its foothold in the overhead systems sector. The market has also seen a valuation increase, with estimates suggesting growth due to rising demand from the e-commerce and consumer goods industries. Fives Group reported strengthening sales figures in the third quarter of 2023, reflecting the growing adoption of automated solutions. Over the past couple of years, significant happenings include KUKA's establishment of a new research center in Beijing in March 2022, aimed at developing cutting-edge overhead conveyor technologies, which has also contributed to increasing competition in the market. Strong growth in infrastructure projects in China is driving this upward trend, leading to increased investment in conveyor systems and automation solutions across various sectors.

China Overhead Conveyor Systems Market Segmentation Insights

Overhead Conveyor Systems Market Function Outlook

Process Link

Process Decoupling

Buffering/Storage

Sorting

Sequencing

Overhead Conveyor Systems Market Technology Outlook

Pouch Sorter

Power & Free System

Overhead Conveyor Systems Market Weight Outlook

0-3 kg

3-5 kg

5-10 g

10-20 kg

20-50 kg

Overhead Conveyor Systems Market Capacity Outlook

Upto 1000 items/h

1000-10,000 items/h

>10,000 items/h

Overhead Conveyor Systems Market Sales Channel Outlook

Direct

Via Main Contractors

Overhead Conveyor Systems Market Automation Grade Outlook

Manual

Semi-Automatic

Automatic

Overhead Conveyor Systems Market Application Outlook

E-Commerce/Retail

Logistics

Production Processes

Market Size & Forecast

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 75.6(USD Million) |

| MARKET SIZE 2024 | 80.0(USD Million) |

| MARKET SIZE 2035 | 140.0(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.219% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Million |

| KEY COMPANIES PROFILED | Tecnoideal, Daifuku, US Conveyor Technologies, Vanderlande, Siemens, Fives Group, Adept Technology, TGW Logistics Group, Interroll, Cavotec, Schaefer Systems International, Systec, KUKA |

| SEGMENTS COVERED | Function, Technology, Weight, Capacity, Sales Channel, Automation Grade, Application |

| KEY MARKET OPPORTUNITIES | Increasing automation in industries, Growth of e-commerce logistics, Rising demand for smart manufacturing, Expansion of automotive sector, Need for space-efficient solutions |

| KEY MARKET DYNAMICS | increasing automation demand, rising manufacturing efficiency, growing e-commerce logistics, environmental sustainability focus, technological advancements in systems |

| COUNTRIES COVERED | China |

Major Players

China Overhead Conveyor Systems Market Segmentation

-

Overhead Conveyor Systems Market By Function (USD Million, 2019-2035)

-

Process Link

-

Process Decoupling

-

Buffering/Storage

-

Sorting

-

Sequencing

-

-

Overhead Conveyor Systems Market By Technology (USD Million, 2019-2035)

-

Pouch Sorter

-

Power & Free System

-

-

Overhead Conveyor Systems Market By Weight (USD Million, 2019-2035)

-

0-3 kg

-

3-5 kg

-

5-10 g

-

10-20 kg

-

20-50 kg

-

-

Overhead Conveyor Systems Market By Capacity (USD Million, 2019-2035)

-

Upto 1000 items/h

-

1000-10,000 items/h

-

>10,000 items/h

-

-

Overhead Conveyor Systems Market By Sales Channel (USD Million, 2019-2035)

-

Direct

-

Via Main Contractors

-

-

Overhead Conveyor Systems Market By Automation Grade (USD Million, 2019-2035)

-

Manual

-

Semi-Automatic

-

Automatic

-

-

Overhead Conveyor Systems Market By Application (USD Million, 2019-2035)

-

E-Commerce/Retail

-

Logistics

-

Production Processes

-

Leave a Comment