Market Summary

India Metal Foundry Products Market Overview:

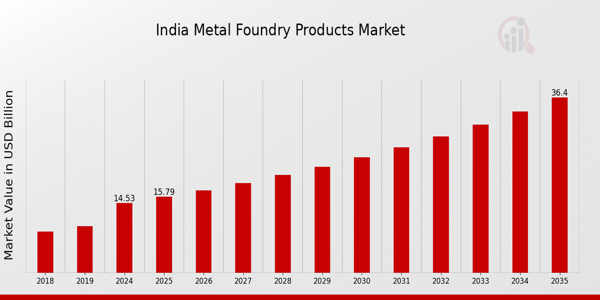

As per MRFR analysis, the India Metal Foundry Products Market Size was estimated at 13.84 (USD Billion) in 2024.The India Metal Foundry Products Market Industry is expected to grow from 14.53(USD Billion) in 2025 to 36.39 (USD Billion) by 2035. The India Metal Foundry Products Market CAGR (growth rate) is expected to be around 8.706% during the forecast period (2025 - 2035).

Key India Metal Foundry Products Market Trends Highlighted

The India Metal Foundry Products Market is experiencing significant trends driven by factors such as rapid industrialization and a growing demand for lightweight and high-strength materials. The increasing adoption of advanced technologies, such as automation and digitalization, is transforming traditional foundry operations, improving efficiency and product quality. Additionally, the government's initiatives, like the Make in India program, are encouraging local manufacturing and attracting investments in foundry sectors. Opportunities in this market are expanding, especially in sectors like automotive, aerospace, and construction, which heavily rely on foundry products.As India aims to become a global manufacturing hub, there is a push to adopt green and sustainable practices in metal casting, which presents a chance for companies to innovate and offer environmentally friendly solutions. With the growing focus on localized sourcing, there is also a call for small and medium-sized enterprises to enhance their capabilities and offer specialized foundry products. Recently, trends a shift towards automation and the use of augmented reality in training and operations within foundries, enhancing skill development and operational accuracy. The integration of Internet of Things (IoT) technology in foundry processes is also gaining traction, leading to improved monitoring of equipment and performance.Furthermore, there is a rising trend of collaboration between foundries and research institutions to foster innovation, which could be beneficial in meeting the growing demands of various industries in India. This growing trend is aligned with the nation's ambition to enhance productivity and embrace technological advancements within the metal foundry sector.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

India Metal Foundry Products Market Drivers

Increasing Demand from the Automotive Sector

The automotive industry is one of the largest consumers of metal foundry products in India. As per the Society of Indian Automobile Manufacturers, the Indian automotive sector is expected to contribute nearly 12% to the country's GDP by 2026, representing a significant growth potential. This rising demand is driven by the government’s initiatives towards electrification and the production of electric vehicles, which require specialized metal parts.For instance, companies like Tata Motors and Mahindra & Mahindra are heavily investing in metal foundry products to enhance their manufacturing capabilities. This growing demand from the automotive sector is projected to fuel the overall growth of the India Metal Foundry Products Market Industry, as increased vehicle production correlates directly with a higher requirement for metal components.

Infrastructure Development Initiatives

The Government of India is undertaking substantial infrastructure development initiatives, aiming to invest around 1.4 trillion USD in infrastructure by 2025, according to reports from the Ministry of Finance. This extensive investment in roads, bridges, and urban development projects is anticipated to lead to an increased demand for metal foundry products. Established firms like Hindalco Industries and Tata Steel are collaborating with the government on several infrastructural projects, thereby influencing the demand for quality metal castings and components.The emphasis on developing infrastructure is likely to accelerate the growth of ‘India’s metal foundry products market and industry’ in the coming decade.

Growth in the Aerospace and Defense Sector

The aerospace and defense industry in India is on an upward trajectory, with the government planning to increase the defense budget to approximately 73 billion USD by 2024. This surge in investment is expected to drive the need for specialized metal foundry products such as aircraft components and military equipment parts. Companies like Hindustan Aeronautics Limited are intensifying their production capabilities and are expected to create substantial demand for foundry products to support their manufacturing processes.The upward trend in this sector is a key driver for the India Metal Foundry Products Market Industry, as it aligns with national priorities focusing on self-reliance in defense manufacturing.

India Metal Foundry Products Market Segment Insights:

Metal Foundry Products Market Technology Insights

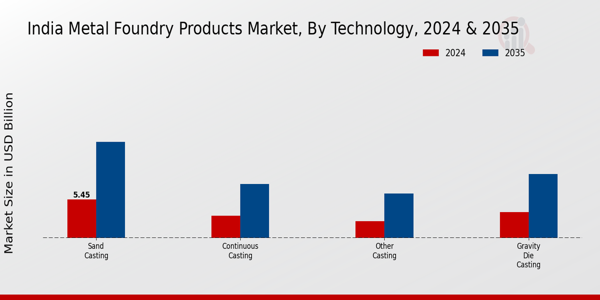

The India Metal Foundry Products Market is significantly influenced by the technology segment, which showcases diverse production methodologies crucial for meeting contemporary demands. The segment is characterized by various casting techniques including Sand Casting, Gravity Die Casting, Continuous Casting, and Other Casting methodologies. Sand Casting is notably a traditional method that remains popular due to its simplicity and versatility in producing complex shapes, making it particularly valuable for automotive and heavy machinery applications.

Gravity Die Casting, on the other hand, is recognized for its ability to create high-quality and detailed components, which is vital in industries like aerospace and electronics. Continuous Casting presents advantages in manufacturing efficiency, particularly beneficial for large-scale production of metal bars and ingots, which cater to the booming construction and infrastructure sectors. Other Casting techniques encompass specialized and innovative methods that are continuously evolving to accommodate niche applications and enhance material properties.

Moreover, as India’s industrial landscape grows, driven by the government's initiatives to bolster manufacturing and infrastructure, the demand for advanced foundry technologies is anticipated to rise. This growth trajectory reflects the broader economic strategy aimed at improving competitiveness in global markets. The prominence of these casting techniques reaffirms their essential role in supporting various sectors, and their adaptation to new materials and technologies signifies a robust push toward modernization within the India Metal Foundry Products Market.

Additionally, factors such as advancements in automation and digitalization are beginning to reshape the operational efficiencies of foundries, thereby enhancing quality control and reducing waste. This technological evolution is expected to further drive investment and innovation across the segment, reinforcing India's position as a significant player in the global foundry market. Understanding these dynamics and their implications on the technology segment is critical for stakeholders making informed decisions in the thriving landscape of the India Metal Foundry Products Market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Metal Foundry Products Market Product Mix Insights

The India Metal Foundry Products Market demonstrates a robust classification within its Product Mix, comprising Ferrous and Non-Ferrous categories. Ferrous products, primarily based on iron and its alloys, significantly contribute to the market due to their inherent strength and durability, making them essential in construction, automotive, and heavy machinery applications. This segment enjoys a majority holding in terms of demand owing to its versatility and cost-effectiveness. On the other hand, the Non-Ferrous segment, which includes materials such as aluminum, copper, and zinc, is gaining traction, especially in industries requiring lightweight and corrosion-resistant materials.This growing preference is driven by the increasing focus on energy-efficient solutions and advancements in technology, encouraging more manufacturers to adopt these materials in their production processes. Additionally, the increasing urbanization and infrastructure development in India are key growth drivers for both segments, presenting ample opportunities for innovation and expansion in the India Metal Foundry Products Market. As these segments evolve, the market statistics reflect a significant transformation toward meeting the demands of various industries while sustaining environmental standards.

Metal Foundry Products Market Application Insights

The Application segment of the India Metal Foundry Products Market plays a critical role in various industries, reflecting the growing importance of metal foundry products across diverse applications. This segment encompasses an array of products such as Backing Plates, Brake Calipers and Carriers, Brake Disks, and Camshafts, which are essential in automotive manufacturing, indicating significant dependency on reliable metal components for vehicle safety and performance. Furthermore, the sector dedicated to Agricultural Machine Parts and Earthwork Machine Parts highlights the essential nature of sturdy materials in enhancing productivity within India's agricultural and construction sectors.The burgeoning demand for efficient Pumps and Industrial Hydraulic Housing underscores the need for high-performance components in industrial applications. Notably, segments like Glass Bottle Mould and Compressor Parts cater to key manufacturing processes that are vital for consumer goods and energy sector operations. The intersection of these various applications shows a complex yet robust landscape where metal foundry products significantly support industry growth and innovation within India’s evolving economy, further driven by technological advances and increased manufacturing efficiency.

Metal Foundry Products Market End-use Insights

The India Metal Foundry Products Market, particularly within the End-use segment, is characterized by significant diversity driven by growing industries such as automotive, construction, and aerospace and defense. The automotive sector represents a major portion, as it requires high-quality metal components for various vehicles, enhancing performance and durability. Meanwhile, the construction industry demands metal products for infrastructure projects, making it a crucial component of national development. The industrial sector also plays a significant role, relying on metal foundry products for machinery and equipment, thus supporting manufacturing and economic growth.Agriculture is emerging as a key area where metal components help improve farming efficiency with tools and equipment. Additionally, water treatment processes utilize specialized metal foundry products to ensure safe and efficient water management. The mining sector also relies heavily on metal components for extraction and processing equipment. Packaging and other end-use applications highlight the versatility of metal foundry products, reflecting a trend toward sustainability and recyclability. As these industries evolve, the India Metal Foundry Products Market is expected to show robust growth, driven by increased demand across these critical sectors.

India Metal Foundry Products Market Key Players and Competitive Insights:

The India Metal Foundry Products Market showcases a landscape shaped by various players providing diverse casting solutions across industries such as automotive, aerospace, construction, and engineering. Competitive insights reveal an actively evolving sector characterized by technological advancements, innovative materials, and increasing demand for high-quality metal products. Factors such as shifting consumer preferences, sustainability concerns, and government regulations play crucial roles in shaping the dynamics of the market. Additionally, companies in this field continually strive to enhance their competitiveness through strategic alliances, modernization of foundry processes, and expansion of product portfolios to meet the demands of a growing industrial base.Zodiac Energy has established itself as a notable participant in the India Metal Foundry Products Market, recognized for its robust capabilities in producing high-quality metal castings that cater to various industrial applications. The company emphasizes its commitment to precision and quality, enabling it to secure a favorable position in this competitive arena. Zodiac Energy's strengths lie in its advanced manufacturing processes and superior foundry technology that ensure consistency in product output. Additionally, it benefits from a strong customer base and has cultivated solid relationships within the industry, which aids in sustaining its market presence. The company's ability to innovate and adapt to changing market conditions further reinforces its competitive edge in delivering top-tier metal products.Aluminium Company of India operates within the competitive sphere of the India Metal Foundry Products Market, focusing on the production of a range of aluminum casting products designed for various applications such as automotive components, industrial machinery, and other essential infrastructure needs. The company is known for its high-quality aluminum alloys and its commitment to sustainable manufacturing practices. Its market presence is strengthened by a significant investment in advanced foundry technologies, allowing for increased production efficiency and product quality. Notably, the Aluminium Company of India has engaged in several strategic mergers and acquisitions, enhancing its capabilities and market position while expanding its product offerings. The company’s strengths are further amplified by its extensive distribution network and customer-centric approach, which enables it to serve diverse sectors effectively within the Indian market context.

Key Companies in the India Metal Foundry Products Market Include:

Zodiac Energy

Aluminium Company of India

Sundaram Clayton

Esab India

Hindalco Industries

Bharat Forge

Steel Authority of India

Precision Pipes & Profiles Company

Jindal Saw

Mohan Spintex

Tata Steel

Carborundum Universal

Hindustan Aeronautics

Minda Industries

Ashok Leyland

India Metal Foundry Products Market Industry Developments

The India Metal Foundry Products Market has recently experienced notable developments, including growth in valuation among major companies such as Hindalco Industries and Tata Steel, largely driven by rising demand in sectors like automotive and aerospace. In July 2023, Bharat Forge announced its initiative to expand its manufacturing capabilities, focusing on high-end foundry products to cater to evolving industry needs. Moreover, Jindal Saw reported an increase in market share following its technological advancements in cast iron and ductile iron pipe production. The market has witnessed a surge in investments in Research and Development, with companies like Esab India enhancing their product line to incorporate smart technologies. Despite the challenges posed by the global supply chain disruptions, industry leaders such as Steel Authority of India have reiterated their commitment to enhancing production efficiency. Minda Industries has engaged in talks regarding potential acquisitions to bolster its product portfolio within the foundry sector, emphasizing growth strategies. Over the past years, the market has adapted to sustainability requirements, with several companies, including Carborundum Universal, working towards eco-friendly production measures, indicating a shift towards greener practices in metal foundry operations.

India Metal Foundry Products Market Segmentation Insights

Metal Foundry Products Market Technology Outlook

Sand Casting

Gravity Die Casting

Continuous Casting

Other Casting

Metal Foundry Products Market Product Mix Outlook

Ferrous

Non-Ferrous

Metal Foundry Products Market Application Outlook

Backing Plates

Brake Caliper and Carriers

Brake Disks

Camshaft and Balancing Shafts

Commercial Vehicle Calipers

Differential Case

Pumps

Industrial Hydraulic Housing

Lanchester Balancing System

Wheel Flange

Glass Bottle Mould

Crank Case

Compressor Parts

Agricultural Machine Parts

Earthwork Machine Parts

Crusher & Grinder Parts

Tooling and Grinding Products

Other Applications

Metal Foundry Products Market End-use Outlook

Automotive

Construction

Industrial

Agriculture

Water Treatment

Aerospace and Defense

Mining

Packaging

Other End-Use

Market Size & Forecast

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 13.84(USD Billion) |

| MARKET SIZE 2024 | 14.53(USD Billion) |

| MARKET SIZE 2035 | 36.39(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 8.706% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Zodiac Energy, Aluminium Company of India, Sundaram Clayton, Esab India, Hindalco Industries, Bharat Forge, Steel Authority of India, Precision Pipes & Profiles Company, Jindal Saw, Mohan Spintex, Tata Steel, Carborundum Universal, Hindustan Aeronautics, Minda Industries, Ashok Leyland |

| SEGMENTS COVERED | Technology, Product Mix, Application, End-use |

| KEY MARKET OPPORTUNITIES | Growing automotive manufacturing demand, Rising infrastructure development projects, Expansion of renewable energy sectors, Increasing demand for lightweight materials, Technological advancements in casting processes |

| KEY MARKET DYNAMICS | Growing automotive industry demand, Increasing infrastructure projects, Technological advancements in casting, Shift towards recycling metals, Rising labor costs |

| COUNTRIES COVERED | India |

Major Players

India Metal Foundry Products Market Segmentation

-

Metal Foundry Products Market By Technology (USD Billion, 2019-2035)

-

Sand Casting

-

Gravity Die Casting

-

Continuous Casting

-

Other Casting

-

-

Metal Foundry Products Market By Product Mix (USD Billion, 2019-2035)

-

Ferrous

-

Non-Ferrous

-

-

Metal Foundry Products Market By Application (USD Billion, 2019-2035)

-

Backing Plates

-

Brake Caliper and Carriers

-

Brake Disks

-

Camshaft and Balancing Shafts

-

Commercial Vehicle Calipers

-

Differential Case

-

Pumps

-

Industrial Hydraulic Housing

-

Lanchester Balancing System

-

Wheel Flange

-

Glass Bottle Mould

-

Crank Case

-

Compressor Parts

-

Agricultural Machine Parts

-

Earthwork Machine Parts

-

Crusher & Grinder Parts

-

Tooling and Grinding Products

-

Other Applications

-

-

Metal Foundry Products Market By End-use (USD Billion, 2019-2035)

-

Automotive

-

Construction

-

Industrial

-

Agriculture

-

Water Treatment

-

Aerospace and Defense

-

Mining

-

Packaging

-

Other End-Use

-

Leave a Comment