Industrial Market Faces Drop in Demand for Copper and Nickel in 2024

Transition metals like copper and nickel are important in the industrial sector. Both of these metals contribute an excellent part in the energy market. Copper and nickel have important roles in the electrification process. Hence, it helps electric vehicle production and indirectly contributes to clean energy transition. The surveys in 2024 show lower demand for copper and nickel in the market. Hence, many industrial factors cause the market's copper and nickel demand to slow down.

Copper and nickel are used extensively in the technological field. These are primarily used in electric components due to their excellent conductivity properties. Copper is known as a good conductor of electricity. Hence, it aids in the demand for copper in the manufacturing of electric vehicles. Moreover, copper plays a crucial role in renewable energy production, too. In 2024, the energy market will experience a drop in demand for copper and nickel. Experts cite that the oversupply of these two transition metals can be an important reason behind the fall in demand for nickel and copper. The drop in sales of electric vehicles is another reason for the low demand for these two metals. Since there is a drop in electric vehicle demand, the demand for metals for this production will fall significantly. The increase in nickel price due to an oversupply of metal from Indonesia is another major factor behind the low demand.

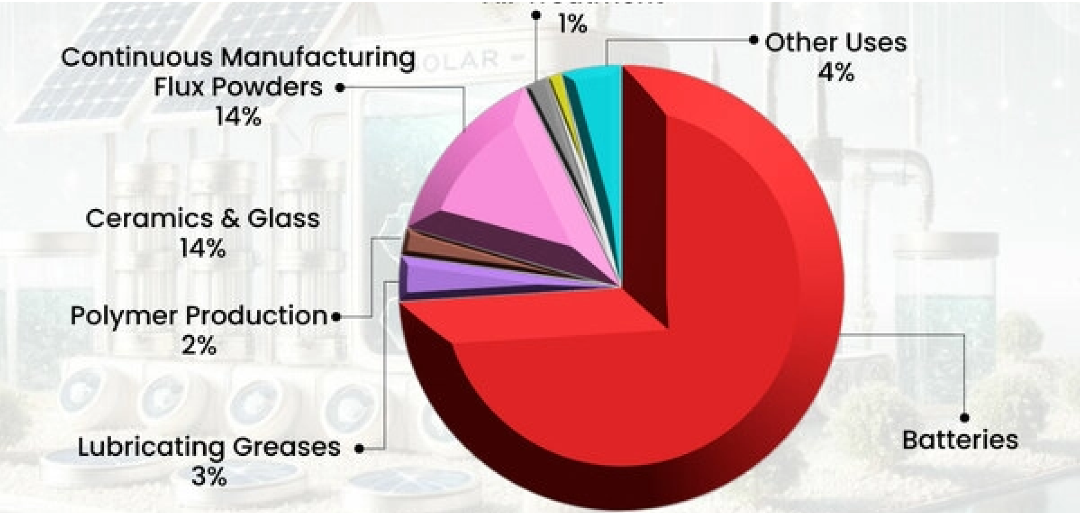

Since clean energy from renewables is important for green energy transformation, copper helps transmit energy. Both metals help in the renewable production and distribution of renewable energy for the clean energy transition. Since nickel is an important component in lithium-ion batteries, nickel is a crucial metal for electric vehicle production. Lastly, both transition metals are important for energy efficiency, storage of energy, and energy transmission. Hence, it helps heavily in the clean energy transition. However, the less demand for nickel and copper may affect the metal market's equilibrium in 2024.